VMI TURNKEY PROPERTY MANAGEMENT GUIDE

Overview

This project is dedicated to creating a suite of documentation designed to complement and enhance the current clearing house project. It aims to meticulously document both the operational workflow of the tally dashboard and outline a proposed process flow for seamlessly incorporating a new leads management system into the existing turnkey solution. This comprehensive documentation effort will serve as a vital resource for ensuring clarity, efficiency, and a smooth integration process for all stakeholders involved.

Documentation Scope Overview

The below Overview outlines the documents that are included in this project.

-

Technical Documentation

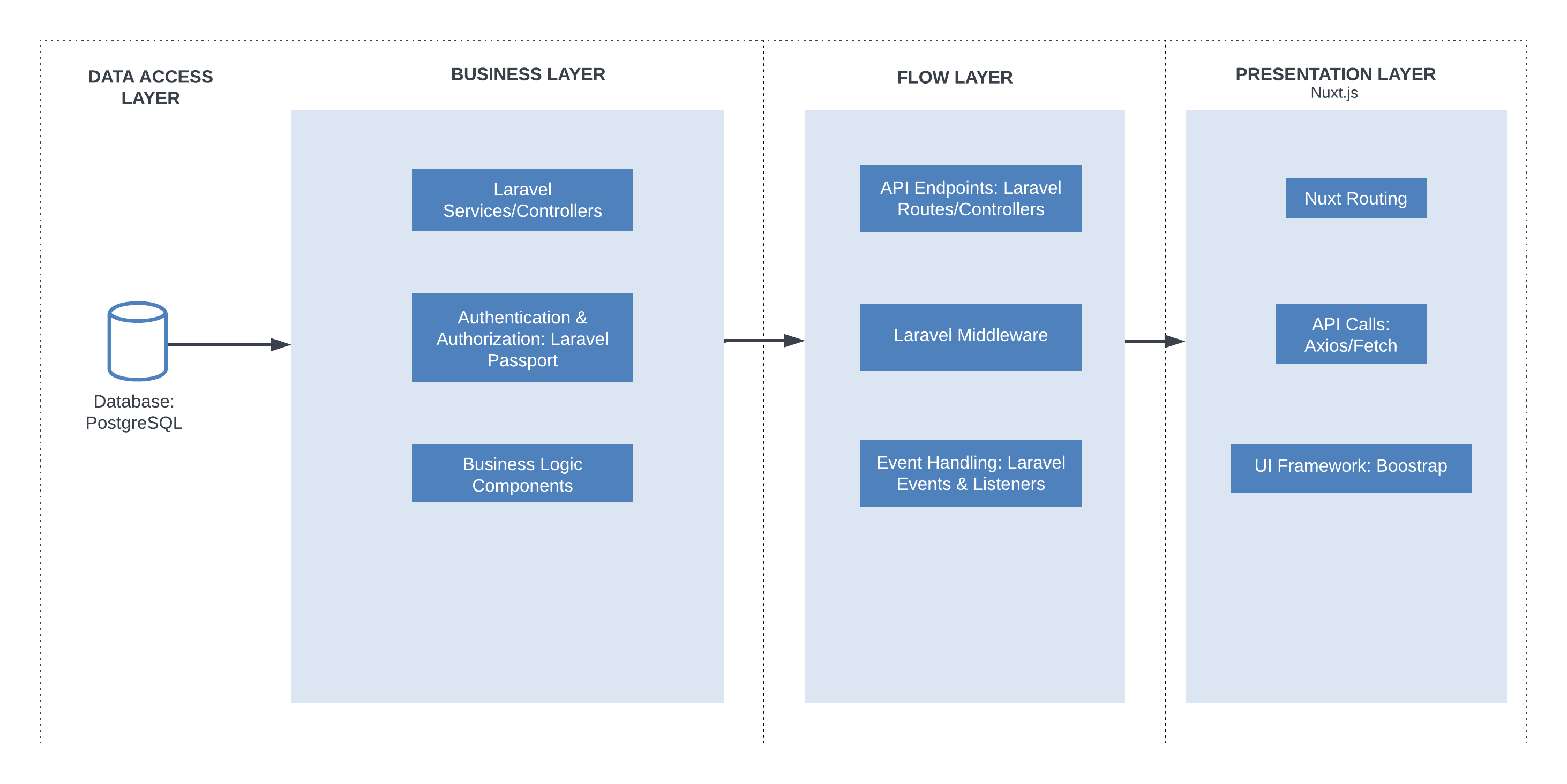

- API Documentation: Outlines specifications for the turnkey application's APIs, detailing endpoints, data exchange formats, and security protocols.

- Architecture Documentation: Provides an overview of the application's architecture, covering the technology stack and component interplay.

- Database Schema: Describes the structure of the existing turnkey database, including tables, relationships, and key constraints.

-

User Documentation

- User Manual: Offers comprehensive guidance in pdf format for end-users, featuring operational instructions and visuals.

-

Developer Documentation

- Development Setup: Details the necessary environment setup for developers, including tools, libraries, and configuration steps.

-

Design Documentation

- Architecture Diagram and Documentation: Visual and written representation of the current turnkey system's architecture, emphasising component structure and data flow.

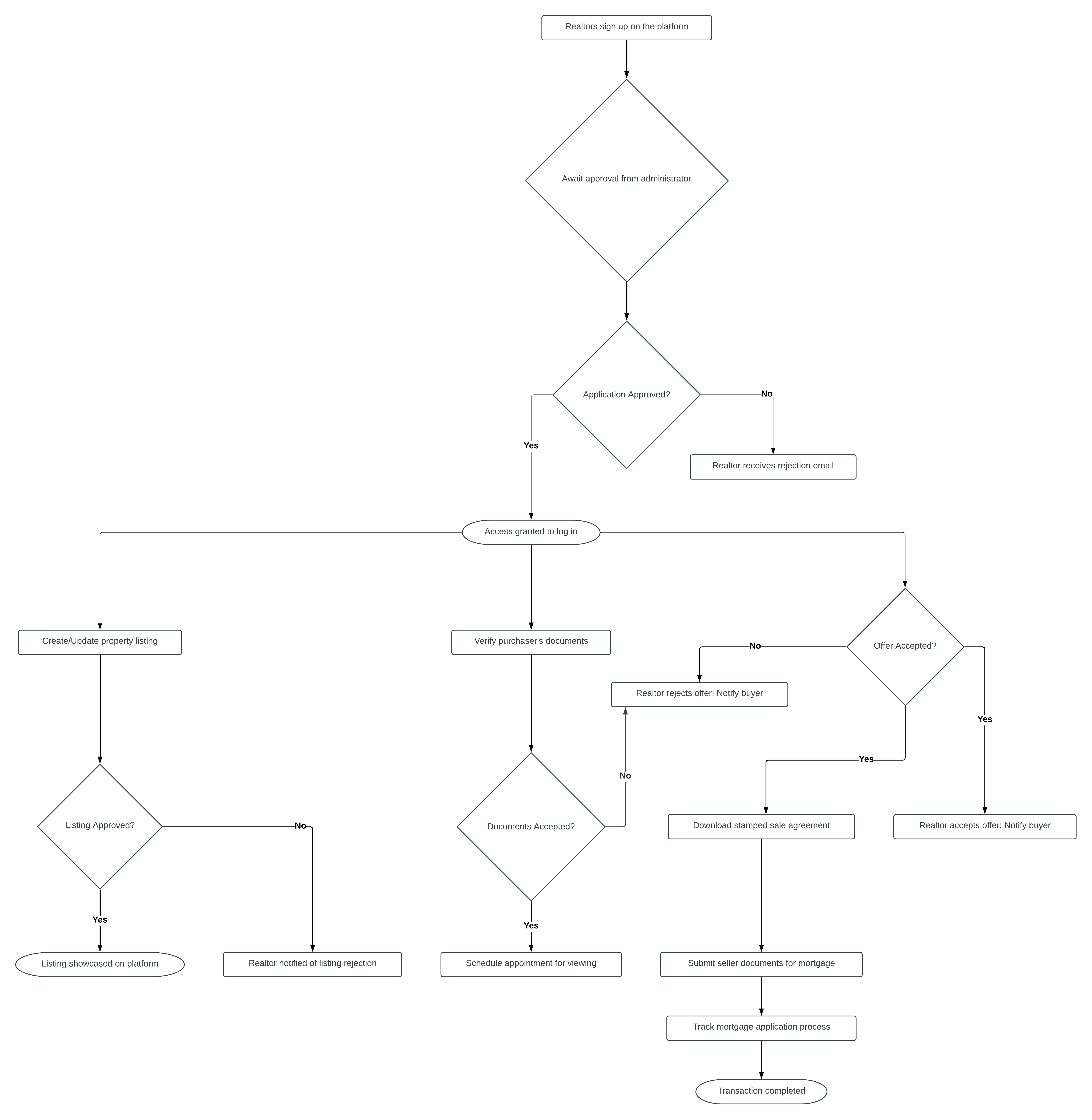

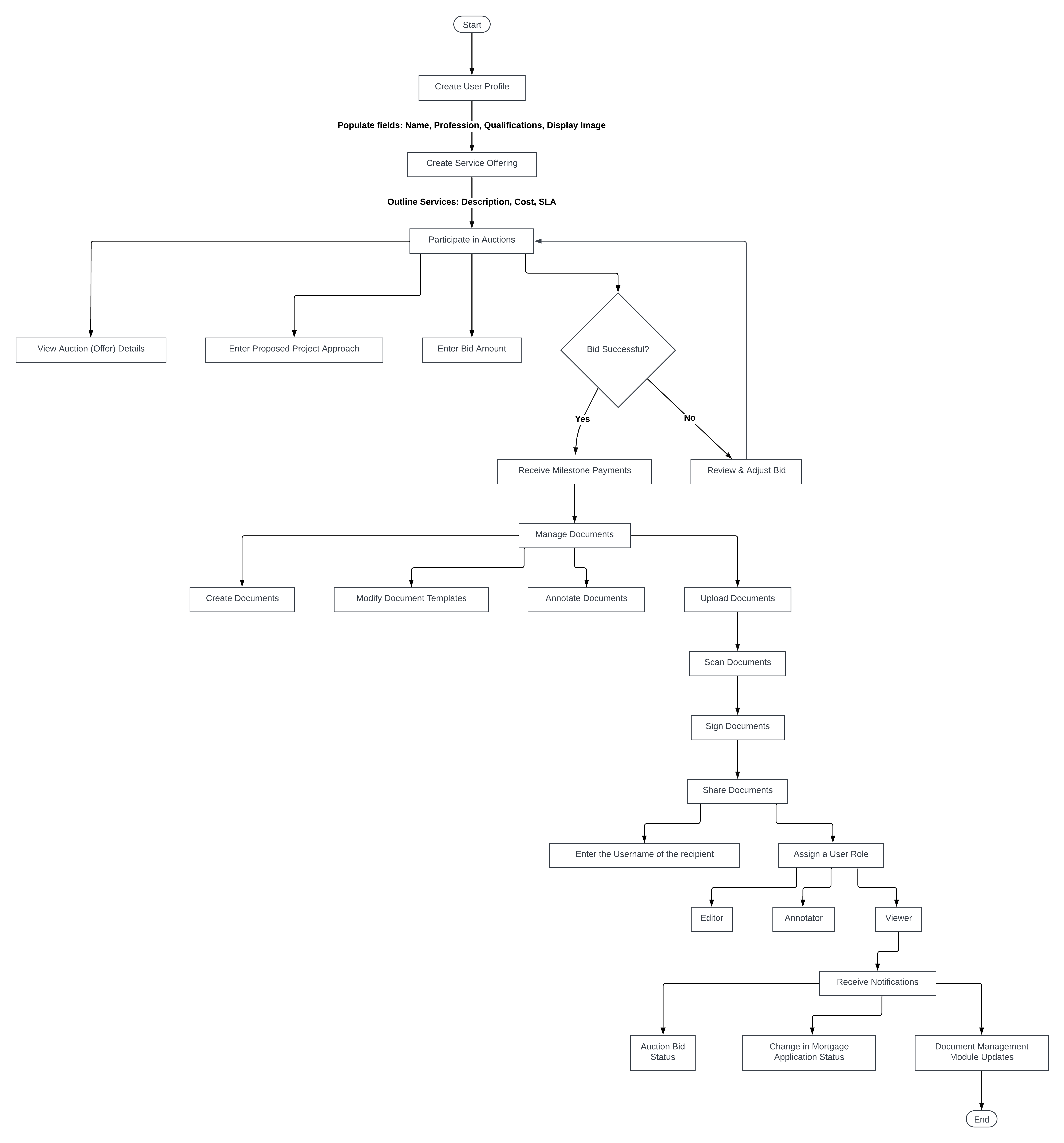

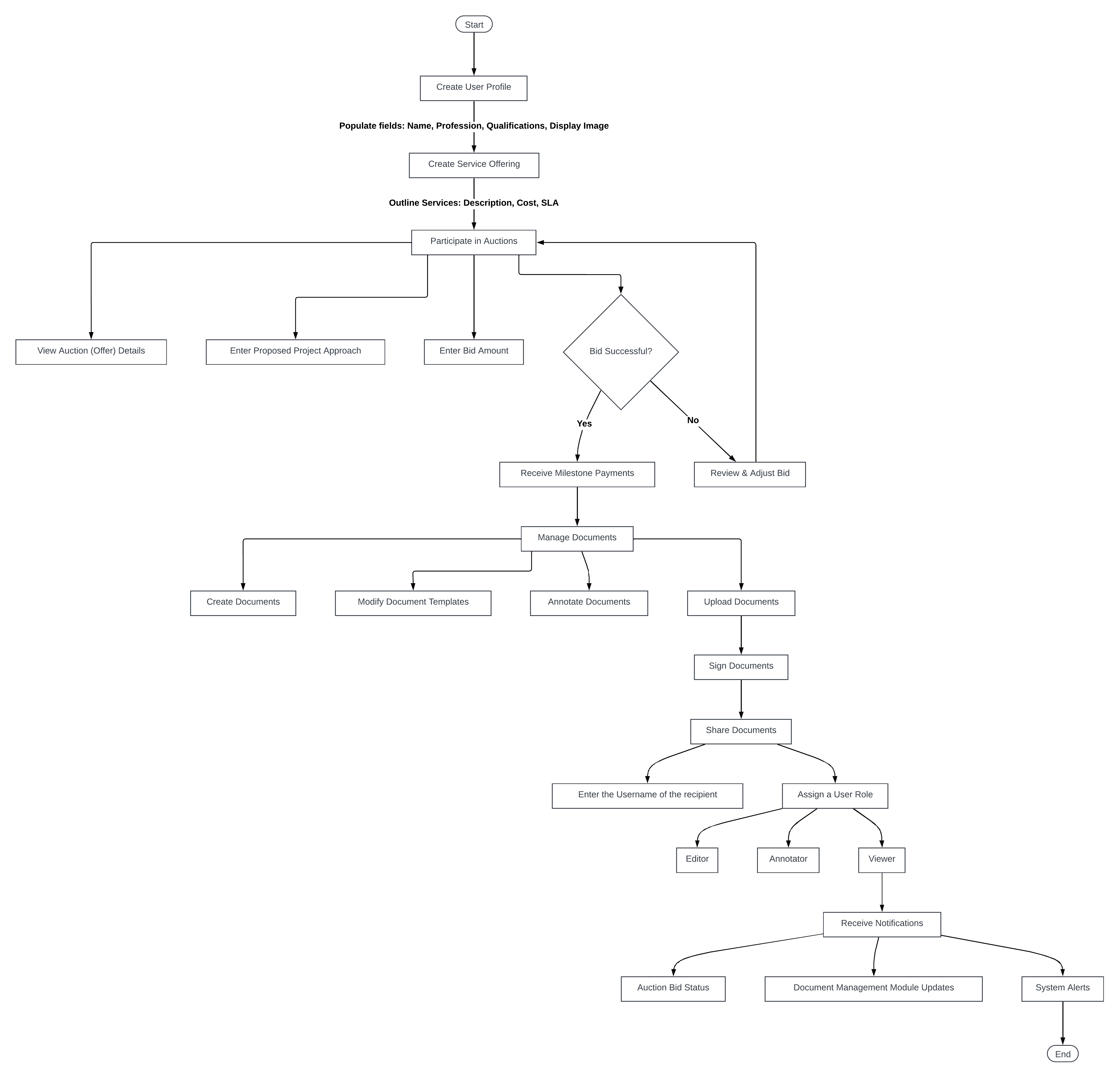

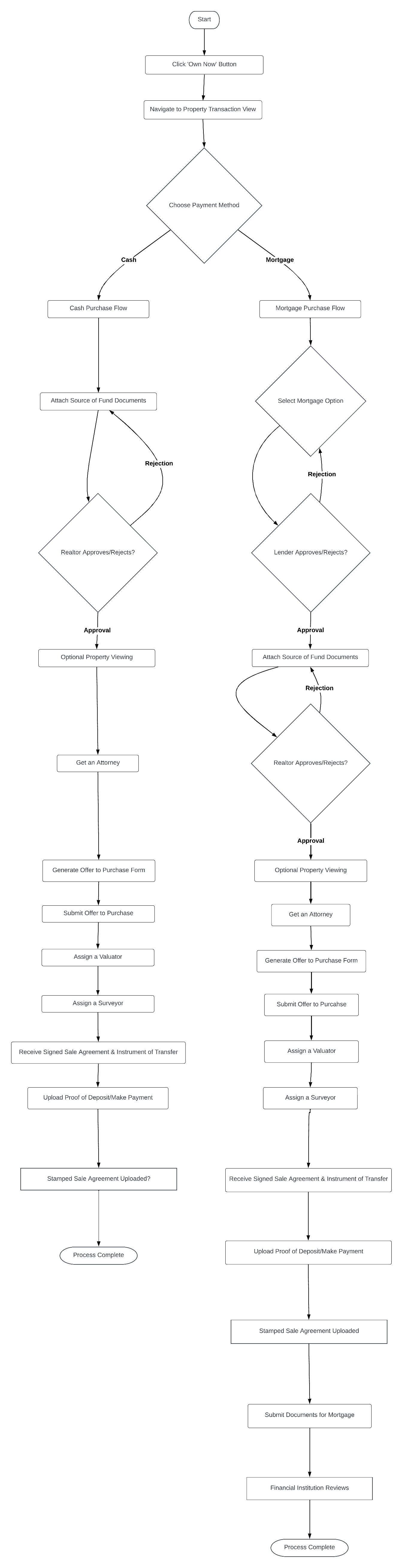

- System Process Flow Diagram and Documentation: Illustrates and describes the workflow and processes within the system, highlighting operational sequences and decision points. This will be done for both the current turnkey solution and also the proposed updates to include the Tally Dashboard.

-

Testing Documentation

- Test Plan: Outlines the testing strategy, objectives, and methodologies to ensure application quality and performance.

- Test Cases/Scripts: Provides detailed steps to validate application functionalities and requirements.

- Test Reports: Summarises testing outcomes, including identified issues and their resolution status.

Architecture Documentation

Technical Documentation

User Manual

User Guide: Mastering the VM Property Services Application for Users and Administrators

This user guide provides step-by-step instructions on how to navigate the VM Property Services application as both a user and an admin. It covers various tasks such as searching for properties, calculating mortgages, selecting realtors and lawyers, submitting offers, and managing transactions. Whether you are a buyer or a property professional, this guide will help you effectively use the application to streamline your property-related tasks.

1. Table of Contents

Navigating The Application As A User

- Finding a property/home

- Calculating a mortgage

- Steps on how to obtain a mortgage

Navigating As A Buyer, Lawyer, Realtor, Valuator, Surveyor, and Bank Officer

- Viewing the list of properties

- Assigning A Mortgage Institution

- Adding A Source Of Fund

- Booking an appointment

- Assigning An Attorney

- Generating offer to purchase letter

- Getting a valuation report

- Getting a surveyor report

- Paying deposits

- Disbursing funds

- Closing the mortgage process

Logging in and Navigating the Backend as Admin

- Accessing the Admin Dashboard

- Managing Users and Data

- Customizing System Settings

2.Getting Started

- Open your web browser and navigate to the House Finder Application website.

- Upon landing on the homepage, you will be presented with a search interface.

3. Navigating the VM Property Services Application

This section of the user guide aims to equip users with the knowledge needed to

effectively use the VM Property Services Application. Starting with the

streamlined property search functionality and learning how to apply various

filters such as location, price, and property type to pinpoint the ideal

property with ease. Following this, we delve into the financial aspects of

property acquisition by introducing our mortgage calculator tool. This feature

is designed to provide users with an estimated monthly mortgage payment,

factoring in the property price, down payment, the loan term, and the interest

rate. This comprehensive guide ensures users have a clear understanding of both

the search process and financial planning.

4. Accessing Properties via the "Life Goals" Tab

- Log in to the application using your credentials.

- Locate and click on the "Life Goals" tab in the main navigation menu.

- Once the "Life Goals" tab is selected, a list of dropdowns will appear.

- From the dropdowns, choose the option labeled "Properties."

- Upon selecting "Properties," the screen will change, and a list of available properties will be displayed.

- Users can then search for specific properties using filters or choose from the options generated.

Property Search Funtionality

5.Property Search Functionality

The VM Property Services Application offers a user-friendly property search feature. Here's how to navigate it:

- Start: Begin by accessing the property search interface.

- Filters: Utilize various filters such as location, price, currency, property type and specifications to refine your search.

- Pinpointing Properties: Use filters to narrow down options and find your ideal property effortlessly.

6. Searching for Property

- Navigate to the search feature, found to the right of your screen.

- Specify the following criteria:

- Building Style: Choose the preferred architectural style or layout

- Type of Property: Indicate whether you're interested in a house, apartment, etc.

- Budget Limits: Set your budget constraints to filter search results accordingly.

- and other filters of your choice

7. - After entering the specified criteria, the search results will display homes that align with your financial plan and meet the specified preferences.

8. - Users can browse through the listings, view property details, and explore additional information such as images, amenities, and more.

The 8-Step Mortgage Process

9. The 8-Step Mortgage Process. Below are the steps involved in obtaining a mortgage:

-

Pre-qualification: Provide basic financial information to receive an estimate of the loan amount you may qualify for.

-

Property Selection: Conduct a property search within the recommended price range.

-

Offer and Acceptance: The process of forming a contract between the vendor and the purchaser to accept or reject a desired price, also deposit will be determined, and a sales agreement will be prepared.

-

Loan Application and Submission: Engage the financial institution and provide necessary documentation then submitting documents related to the property, applicants, and proof of income/credit information.

-

Credit Analyst Preliminary Review: Conduct a preliminary review of provided documents and information.

-

Underwriter's Decision: Approved/Denied: After careful analysis, the underwriter decides on loan approval.

-

Securities and Registration (Mortgage Registration): Conduct mandatory checks to ensure no restrictions on the property.

-

Funding and Disbursement: The purchase process is complete, and funds are disbursed.

10. Accessing the 8-Step Mortgage Process

- Locate and click on the "Resources" dropdown in the main navigation menu.

- From the dropdown menu options, select "The 8-Step Mortgage Process."

11. - Upon selecting "The 8-Step Mortgage Process," users will be directed to a detailed guide outlining the steps involved in obtaining a mortgage.

12. Calculating Mortgage via "Calculators" Tab

- Navigate to the "Calculators" tab located in the main menu.

- Select the "Mortgage" dropdown from the options available.

13.Financial Planning with the Mortgage Calculator

In addition to property search, the application offers a mortgage calculator tool. Here's how to use it:

- Accessing the Mortgage Calculator: Locate the mortgage calculator feature within the application by navigating to the tab Calculator

- Input Parameters: Enter relevant details such as property price, down payment, loan term, and interest rate.

- Estimated Mortgage Payment: Receive an approximate monthly mortgage payment based on the provided information.

14. - Upon selecting the "Mortgage" dropdown, users will be presented with various mortgage calculation tools and options.

- Users can input relevant details such as loan amount, interest rate, loan term, and down payment to calculate their mortgage payments.

Additional Tips:

- Use the provided fields to enter accurate information for precise mortgage calculations.

- Save or print the calculated mortgage details for future reference.

15. Clicking the "Apply NHT" button initiates the process for applying NHT benefits for the selected property.

Additional Tips:

- Ensure you meet the eligibility criteria for NHT benefits before proceeding with the application.

- Review the application process carefully and provide accurate information to avoid delays.

16. Users may select homes they are interested in to see mortgage breakdown.

17. Navigating As A Lawyer, Buyer, Realtor, Evaluator, Surveyor, And Bank Officer

- Lawyers: Details the document management system, secure communication channels with clients, and a repository for legal resources and templates.

- Buyers: Offers tools for searching properties, mortgage calculators, and guides for making offers, aimed at simplifying the home-buying journey.

- Realtors: Provides access to listing management, appointment scheduling, and client relationship tools to enhance property selling and buying experiences.

- Evaluators: Includes features for property valuation, access to historical data, and report generation tools to assist in accurate property assessment.

- Surveyors: Outlines tools for uploading and managing survey reports, integrating geographic information systems (GIS), and collaborating with other real estate professionals.

- Bank Officers: Describes functionalities for loan origination, mortgage processing, and financial product offerings tailored to both buyers and real estate investors.

18. Buyers interested in browsing the full range of available properties can start by locating the "Properties" dropdown menu on the website's main navigation bar. Within this menu, they'll find the "All Properties" option, which, when clicked, will direct them to a detailed page showcasing an extensive selection of properties for sale or rent.

This page typically includes filters and search tools that allow buyers to refine their search based on specific criteria such as location, price range, property type, and more, helping them to efficiently find listings that match their preferences and requirements.

19. Buyers looking to explore available properties can do so by navigating to the "Properties" dropdown menu and selecting the "All Properties" option. This will display a comprehensive list of properties currently on the market.

20. To locate a particular property, start by identifying the search bar. Once

you've found the search bar, proceed to enter the exact name or relevant

keywords associated with the property you're seeking. As you type, the system

may offer suggestions or autocomplete options based on your input.

After entering the desired property name or keywords, press the

"Enter" key or click on the search icon to initiate the search.

The results page will display a list of properties that match your search

criteria, from which you can select the one you are interested in for more

details.

21. To allocate a realtor to a specific property, buyers should click on the

hamburger icon (three horizontal lines) situated next to the property's listing

details.

This action will open a few options including view, set inactive, and assign

realtor. Click "Assign Realtor" to assign a realtor to a property.

22. To proceed with your property purchase, first ensure you are logged into your

Purchaser/Buyer account.

Once logged in, navigate through the platform to locate the home that interests

you. Upon finding the desired property, click the "Own Now" button,

typically positioned prominently on the property's listing page.

Clicking this button will initiate the process to move forward with the

acquisition of the property.

23. To select your payment method, first pick a preferred purchase option, such as mortgage or cash. After making your choice, click on the "Continue" button to proceed to the next step.

24. To initiate a search for a financial institution, click on the button labeled "Search for a Financial Institution." This will lead you to a dedicated section within the platform where you can input specific criteria or keywords related to the financial institutions you are interested in.

The system may provide options to refine your search based on factors such as location, services offered, or ratings. Once you enter your search parameters and initiate the search, the platform will display a list of financial institutions that match your criteria.

25. To select a financial institution, carefully review the list that appears on

your screen, which may include various banks, credit unions, or other lending

entities.

Each institution listed will offer different terms, rates, and services,

consider what aligns best with your financial needs and goals.

Once you've evaluated the options, click on the name of the financial

institution you wish to engage with.

This action will take you to another page for further steps, such as filling out

a form or initiating contact, to begin your financial dealings with the selected

institution.

26. Purchasers/Buyers are required to upload necessary documents during the pre-approval process to verify their financial stability and eligibility for a mortgage or loan. These documents typically include proof of income, employment verification, and credit reports, among others.

Lenders use this information to assess the buyer's ability to repay the loan, determine the loan amount they qualify for, and establish appropriate interest rates. Uploading these documents promptly and accurately is crucial as it enables financial institutions to conduct a thorough evaluation, ensuring that buyers can secure financing that aligns with their financial situation and the property they intend to purchase.

27. Purchasers or Buyers looking to initiate the pre-approval process for a loan or mortgage are required to provide specific documents that verify their financial background and creditworthiness. This step is crucial for lenders to assess the buyer's ability to afford the property they are interested in. To upload these documents:

- Locate the "Choose File" button on the platform, which is typically found in the section dedicated to loan pre-approval or financial verification.

- Click on this button, which will open a file explorer window on your device.

- Navigate through your files and select the document(s) you need to upload. These might include recent pay stubs, tax returns, bank statements, or any other required financial documentation.

- Once you've selected the right file(s), click "Open" in the file explorer window to attach the document(s) to your application.

- After attaching all necessary documents, click "Upload" to ensure the documents are properly submitted for review.

28. Bank officers can review pre-qualification requests by clicking on the "Pre-qualification Request" button. This action allows them to access and evaluate applications from potential borrowers seeking to determine their eligibility for loan products.

29. Bank officers should click on the hamburger icon, which presents a menu containing options to pre-qualify, disqualify, or review documents related to loan applications. To initiate the pre-qualification of an applicant, they should select the "Pre-Qualify" option from this menu.

30. Buyers looking to progress through their application process for purchasing a property or securing a loan can do so by taking the following detailed steps:

- Review Your Information: Before proceeding, ensure that all the information entered in the current phase of the application is accurate and complete.

- Click on "Continue": After reviewing your information and ensuring everything is in order, click on the "Continue" button. This action signals that you have completed the current section and are ready to move on to the next phase.

Next Steps: Upon clicking "Continue," the application will automatically take you to the next section, this involves additional information input, further document uploads, or a review section. In some cases, you might encounter a brief loading period as the system processes your progress.

31. To submit proof of funds, start by clicking on the "Choose File" button to select the document from your device. After selecting the appropriate file, proceed by clicking on the "Upload" button to successfully submit the document.

32. Realtors looking to access job requests can do so by navigating to the "Sell Properties" button. Upon clicking the "Sell Properties" button, realtors will be directed to a section where job requests are listed. This section will provide detailed information about each request, including property details, seller expectations, and any specific requirements for the realtor. By accessing these job requests, realtors can efficiently connect with potential clients, understand their needs, and initiate the process of listing and selling properties.

33. Once a buyer's source of funds has been submitted and reviewed, to proceed with the next steps, click on the hamburger icon (three horizontal lines) usually located next to the buyer's submission details.

Upon clicking, a dropdown menu will appear, presenting several options such as

- View Documents

- Approve

- Reject

Depending on the review outcome, choose one of the following options:

- Approve: If the buyer's financial documents meet the criteria, select "Approve" to advance the application.

- Reject: If the documents are insufficient or do not meet the requirements, choose "Reject." Provide a reason or feedback for clarity.

34. To progress to the subsequent stage in the process, locate and click on the

"Continue" button. This action typically signifies that you have

completed the current section and are ready to move forward.

By clicking this button, the system will automatically navigate you to the next

phase, which involves inputting additional information requests. Ensure that all

required fields and any necessary information in the current section have been

accurately filled out before proceeding to avoid any disruptions in your

progression.

35. Scheduling Appointments with the "Add Appointment"

-

Upon clicking the "Add Appointment" button, a form or dialog box will appear, allowing realtors to input details for the proposed meeting.

-

Realtors can specify the date, time, location, and purpose of the appointment (e.g., property viewing, consultation, discussion).

-

After filling in the required information, realtors can save the appointment, which will be added to the calendar or appointment list.

Additional Tips:

- Use descriptive titles for appointments to easily identify their purpose (e.g., "Property Viewing - 123 Main St").

36. Scheduling an Appointment

- Upon selecting a suitable time and clicking "Request This Time," your appointment request will be submitted.

- You may receive a confirmation message indicating that your request has been successfully submitted.

37. To finalize the scheduling of your appointment, follow these detailed steps:

- Review Your Selection: Before confirming your appointment, ensure you have selected the correct date and time that best suits your availability.

- Locate the "Book Appointments" Button: This button is typically found at the top right of the calendar screen, clearly labeled to indicate the action of booking the appointment.

- Click on "Book Appointments": Once you have confirmed that all the information is correct and you are ready to proceed, click the "Book Appointments" button. This action signals the system to register your appointment based on the selections and information you have provided.

38. Buyers looking to move forward in their purchasing journey or application process can do so by following these detailed steps:

- Review Your Current Information: Before advancing, take a moment to carefully review all the information you've provided in the current step. This ensures that all your entries are accurate and complete, which is crucial for a smooth continuation of the process.

- Locate the "Continue" Button: The "Continue" button is typically positioned at the bottom of the section you are currently working on. It's designed to be easily noticeable, often highlighted or emphasized to draw your attention.

- Click on "Continue": After confirming that all the information is correct and you're ready to move on, click the "Continue" button. This action signals the system that you have completed the current phase and are ready to proceed to the next.

39. Buyers interested in securing legal representation for their transactions have the option to either find a lawyer through our platform or appoint one they already have. To do this, they should click on the "Search" button to browse available legal professionals listed on our site or select the "Use My Own" button if they prefer to enter the details of a lawyer they've personally chosen.

40. To secure the services of a turn-key legal representative, buyers should follow these detailed steps:

- Access the List: Navigate to the section of the platform where turn-key legal representatives are listed. This list is typically curated to include professionals with expertise in real estate transactions, offering a range of services from contract review to closing assistance.

- Review the Options: Take some time to review the list of available legal representatives. Each listing includes the professional's name, qualifications, and areas of expertise. This information is crucial in helping you make an informed decision.

- Make Your Selection: Once you have evaluated the options and identified the legal representative who best meets your needs, locate their name on the list.

- Click on the Corresponding Name: Click on the name of the legal representative you wish to engage.

- Confirm Your Choice: After clicking on the chosen legal representative's name, you may be prompted to confirm your selection or provide additional information to facilitate the engagement.

41. To advance in the process of selecting a legal or professional representative, follow these detailed steps:

- Review the Representative's Details: Before making your selection, ensure you have thoroughly reviewed the information provided about the representative.

- Locate the "Choose This Representative" Button: After deciding on the representative you wish to engage with, look for the "Choose This Representative" button.

- Click on the Button: Click the "Choose This Representative" button to indicate your selection. This action typically signals your preference. After which, you will be redirected to the next steps in the engagement process.

42. Lawyers working on behalf of purchasers have the ability to review incoming job requests through the platform. These requests may include various legal tasks related to real estate transactions, such as contract reviews, due diligence, or closing services. Each listing will provide detailed information about the request, including the nature of the legal work, the client's details, deadlines, and any specific requirements or preferences. This feature enables lawyers to efficiently manage their workload, prioritize tasks, and engage with potential clients.

43. Lawyers who represent purchasers have a systematic way to access job requests relevant to their field of expertise. Here’s a detailed breakdown of how they can navigate this process:

- Navigate to the Job Requests Section: Once logged in, lawyers should look for the section or tab labeled something akin to "Job Requests. This section is dedicated to listing the various requests or inquiries from potential clients or entities seeking legal assistance.

- Click on the "Job Request" Button: By clicking this button, lawyers will be taken to a list or dashboard that displays all the current job requests available. Each listing will typically include details about the job, such as the nature of the legal assistance required, the location of the property or client, any specific qualifications or experience sought, and the proposed timeline or deadline for the job.

44. To thoroughly review a buyer's request, follow these detailed steps:

- Identify the "View Request" Button: Within the list of requests, each entry will typically have an associated "View Request" button or link. This button is designed to give you access to the full details of the buyer's request.

- Click on "View Request": Click this button to open the detailed view of the buyer's request. The system may take you to a new page where the complete information regarding the request is displayed.

- Review the Details: Take your time to carefully read through all the information provided in the buyer's request. This may include their desired property type, location preferences, budget range, any specific features they are looking for, and their timeline or urgency level.

45. Lawyers representing purchasers have the option to either accept job requests as they are or submit counter bids if the terms or compensation do not meet their expectations. This process allows for negotiation and agreement on terms that are satisfactory to both the lawyer and the client.

46. To complete the process of engaging a lawyer, buyers must enter their credit card details and then select the "Pay" button to finalize the transaction.

47. To advance to the next stage in the application process, you should carefully follow these detailed steps:

- Review Your Current Entries: Before moving forward, take a moment to go over all the information you've provided in the current stage of the application. This ensures that all your inputs are accurate and complete, minimizing the chances of errors or omissions that could affect your application's progress.

- Click on "Continue": Once you're satisfied that all the information is correct and complete, click the "Continue" button. This action signals to the system that you are ready to move on from the current section and proceed to the next phase of the application.

48. Buyers can initiate the creation of an offer to purchase by selecting the "Incomplete" button, which typically indicates that certain actions or documents are pending completion.

49. To ensure your progress is preserved and to move forward, follow these detailed steps:

- Review Your Inputs: Before saving, take a moment to review all the information you've entered or changes you've made. This step is crucial to ensure accuracy and completeness, as it might be more challenging to correct errors later.

- Locate the "Save" Button: Typically, the "Save" button can be found at the bottom of the page you are working on.

- Click on "Save": Once you've confirmed that all the information is correct, click the "Save" button. This action commands the system to store your current data and progress to the next stage. There might be a brief moment of loading as the information is being saved.

50. To finalize and submit your offer, follow these detailed steps:

- Review Your Offer: Before submission, carefully review all the details of your offer. Ensuring the accuracy of these details is crucial, as they will form the basis of your proposal and potential agreement.

- Locate the "Submit" Button: The "Submit" button is typically positioned to the bottom right of the form where you've entered your offer details. It's designed to be easily identifiable.

- Click on "Submit": After confirming that all the information in your offer is correct and you're ready to proceed, click the "Submit" button. This action sends your offer to the seller or the seller's agent for review. Be prepared for a brief loading period as the information is processed and transmitted.

51. Realtors have the option to either accept or reject incoming purchase offers by navigating to the "Review Offers" tab. This will reveal the purchase offers available for the realtor to reject or accept. Click the corresponding button to either reject or accept an offer.

52. To solidify your decision regarding an offer, whether to accept or reject it, you should follow these steps:

- Make Your Decision: Carefully review the offer in question and decide whether you want to accept or reject it. Consider all aspects of the offer, including price, terms, conditions, and any contingencies that may apply.

- Select Your Choice: Once you've made your decision, indicate your choice by selecting the appropriate option, typically presented as "Accept" or "Reject."

- Locate the "Continue" Button: After indicating your decision, look for the "Continue" button. This button is located to the bottom right of the page.

- Click on "Continue": Click the "Continue" button to proceed. This action will register your decision in the system and may lead to a confirmation page or prompt further actions based on your choice.

53. Buyers seeking a valuator should press the "Search" button to initiate their search. This will bring up a list of approved and licensed valuators where you will be allowed to choose a specific valuator.

54. To select a preferred valuator, click the appropriate name from the list and then that Valuator along with the services they offer will be selected. Click "Choose This Valuator" to confirm your choice move forward.

55. Valuators can view new job requests by selecting the "Job Requests" tab. A screen with Job Requests and their details will be shown to the user. These details include the request Date, type, cost, due date, property and status.

56. Viewing Job Requests

- Upon clicking "View Request," detailed information about the selected job request will be displayed.

- When filtering by status, the table will update to show only job requests that match the selected category.

Additional Tips:

- Use the search bar or additional filters to narrow down results further.

57. Viewing Job Requests

- Upon viewing a job request, you will see two tabs (Offers and Delivery).

- Under the "Offers" tab, specific details about the job request will be displayed, including the offer price, deposit fee, and requested time.

- Valuators have the option to either accept offers or submit counter bids.

- To accept an offer, click the "Accept" button.

- To accept a counter bid, click the "Counter Bid" button.

58. Buyers must enter their credit card details to secure a valuator's services and then click the "Pay" button to complete the process.

59. Now under the Delivery tab Valuators can upload valuation reports. To do so one should click the "Upload File" button where they can upload a pdf or doc file which contains their report.

60. After your file has been uploaded to the system you can will be presented with the option to download the Valuation Report which you can do by clicking "Download Valuation Report". If you want to move on click the "Continue" button to move on to the Surveyor's report.

61. Buyers may search for surveyors by clicking the "Search" button and entering the desired surveyor's details.

62. To select a surveyor, click on the desired individual. Their bio and services offered will be displayed. If you are satisfied with this surveyor then click the "Choose This Surveyor" button in order confirm selection of this surveyor.

63. Surveyors can view new Job requests by clicking on the "Job Request" tab. This will bring you to the Job request page where you can view details about Job Requests.

64. All the Job Requests will be listed and an overview of their request date, request type, cost, due date and property will be listed. For more details about a specific request, click the "View Request" button and it will bring you to a page which contains more details about a particular request.

65. On this page surveyors can view specific details about a request such as service delivery, time budget, offer price and deposit fee. Users have the option to accept the bid or propose a counter bid. This can be done by either clicking the "Accept" or "Counter Bid" button depending on which corresponds with their desired action.

66. In order to complete the process of choosing a surveyor, users must enter their credit card information and approve the purchase by pressing the "Pay" button.

67. Once payment is completed, surveyors may upload report by clicking the "delivery" tab. Afterwards click the "Upload File" button, where the surveyor will be prompted to choose and upload their report in the form of a pdf or doc file.

68. The Purchaser's Lawyer can view assigned properties by selecting the "Attached Properties" tab. This will bring up a tab that will show the assigned properties and an overview of their details.

69. The user will see a table where the attached property along with it's address, property type, number of bedrooms, number of bathrooms, price and status will be displayed. To get more information on a specific attached property, click the "View Sale" button. This will bring the user to a page which contains more details about the selected property.

70. After choosing to view the Sales details of a specific property, the Purchaser's Lawyer will see additional information about the sale. Under the delivery tab the Purchaser's Lawyers may submit the sale agreement and instrument of fund by clicking the "Choose File" option. They will be prompted with the option to choose a pdf or doc file. The Purchaser's Lawyer will then be able to upload their chosen file. To view what they have uploaded the Purchaser's Lawyer can click "Download Signed Sale Agreement" or "Download Signed Instrument Of Transfer" button.

71. After Purchaser's Lawyer has uploaded both documents they can click continue to end the process. If they want to check what they have uploaded they can click the "Download Signed Sales Agreement" or "Download Signed Instrument of Transfer" button.

72. Buyers can make deposits either by uploading proof of payment or by using a debit/credit card. To upload proof deposit click the "Upload Proof of Deposit" button while to pay with your credit or debit card click the "Pay wit Debit/Credit Card" button. If you click the "Upload Proof of Deposit Option" it will prompt the buyer to upload a file.

73. After the user uploads the png, jpep, pdf or doc file they may click the "Submit" button to finalize the process. If they want to view what they have uploaded they can click the "Download" button. If the user wants to remove the file that they uploaded they can press the "Delete" button. The user should press the "Submit" button in order to complete the submission of their Proof of Deposit.

74. The user will be shown the name of the file which they had previously submitted as proof of a deposit. To view their submission the user can click the "Download" button. In order to complete the "Deposit Payment" step, the user should click the "Continue" button.

75. The Purchaser's Lawyer will see the name of the specific Sale Agreement. In order to upload the relevant document the user can upload the sale agreement by selecting the "Choose File" option. They will be prompted to upload a jpeg, png pdf or doc file which contains the Stamped Sale Agreement.

76. This page is used to collect the seller documents for a specific sale. Realtors may upload documents for processing by clicking the "upload" button where they will be prompted to upload a pdf or doc files of the relevant information.

77. After their upload is complete, they can choose to either download or delete what they have uploaded by pressing the corresponding icon underneath the action column. If they realtor is finished their file upload they should click the "Submit" button to proceed.

78. This page deals with the collection of any additional documents the Purchaser needs to upload. The page will list all uploaded document's names and upload date with a table. The Purchaser will also be able to download a specific document by clicking the button under the "Action" heading. Purchasers may upload any additional document then select " submit mortgage application" to proceed.

79. Bank officers are able to review mortgage applications by navigating to the "Mortgage Applications" tab. This will bring them to a page that will show all Mortgage Applications.

80. Bank Officers will see a table containing the mortgage product, applicant name, property, property price. To Accept, Reject or view documents for applicants, Bank Officers may select the hamburger button in the "Action" tab. This will display the options and the Bank officer should click their preferred action.

81. Upon approval of a mortgage, Bank Officers can upload the commitment letter by clicking the "Choose File" option. They will be prompted to upload a pdf or doc file. After they have selected their specific file, Bank Officers should click the "Submit" button to finalize the submission of the selected documents.

82. Bank Officers can attach letter of undertaking by clicking the hamburger button in the "Action" column. They will be given the option of either viewing the documents which have already been uploaded or attach a letter or undertaking. The Bank officer should click the "Attach letter of undertaking" option upload the letter of undertaking.

83. Bank officers have the option to disburse funds or view documents by navigating through the hamburger menu under the "Action" column. They will be provided with the option to either "View Documents" or "Disburse Funds". The Bank officers should click Disburse Funds option.

Administrator Role

84. Logging In & Navigating The Backend As Admin

Welcome to the User Documentation section dedicated to administrators on logging

into the VM Property Services Application and navigating the backend. This guide

offers comprehensive instructions for the initial login process and navigating

the backend efficiently.

85.Logging In

- Access the VM Property Services Application login page.

- Enter your administrator credentials (username and password).

- Click on the "Login" button to access the admin dashboard.

86.Navigating the Backend

Once logged in, administrators can utilize various backend functionalities:

- Admin Dashboard: The central hub providing an overview of system activities and key metrics.

- Partners: Add, edit, or remove partner information. Manage partnerships and agreements.

- Lenders: Add new lender details, update existing information, and maintain communication channels with lenders.

- Documents: Upload, organize, and access various documents securely. Maintain a comprehensive repository of essential paperwork.

- Fees: Fees section allows you to configure and manage fee structures associated with property transactions, such as commission fees or service charges

- Properties: Properties section serves as the core database for all property listings available within the application

87. Accessing Featured Partners via the Admin Dashboard

- Upon selecting "Featured Partners," the screen will display a list of all partners currently featured within the application.

Additional Tips:

- Use filters or search functionality to narrow down the list of featured partners if needed.

88. - Users can view details of each featured partner, including their name, contact information, and any additional relevant details.

Additional Tips:

- Click on a partner's name to access further details or make edits if necessary.

89. If you wish to access a comprehensive list of all lenders added to the system, simply select the "Lenders" option. This will provide you with a detailed overview of all registered lenders within the VM Property Services Application.

90. Admin may add a lender by Selecting the "Add Lending Institution" button.

91. To view document types, simply select the "types" option from the dropdown menu within the "Documents" section. This feature allows users to categorize documents based on their type, making it easier to organize and access specific document categories such as contracts, agreements, certificates, and more..

92. Adding a Document Type from Admin Dashboard

- Clicking on "Add document type" will open a new window or form where you can input the details of the new document type.

- You will be prompted to enter the name, description, and any additional information related to the document type.

- After completing the form, submit the information to add the new document type to the system.

Additional Tips:

- Ensure to provide clear and concise information when adding a new document type.

- Document size should meet the system required size found in the technical documentation

93. If you would like to view a list of all document templates created, click "templates" from the document dropdown.

94. For each document, you may create a template by clicking the " Add document template button.

95. Viewing Fees from Admin Dashboard

- After selecting "fees," administrators will be able to view and manage the list of fees utilized within the system.

- Each fee will be listed along with its name, transaction type, and fee type..

Additional Tips:

- Administrators can edit or delete existing fees as needed.

- Changes made to fees will affect their usage across the entire system.

96. - New fees can be added to the system by clicking on the appropriate button or link.

97. Customize fees by adding a name, transaction type, and fee type. Note, fees can be enabled and disabled at any point and the feature property type exclusively permits a fixed cost.

98. If you would like to view a list of all properties, Click "All Properties" under the "Properties" main menu.

99. Click the hamburger icon to view, set inactive or assign realtor to a property.

100. Viewing Wishlist Items from Admin Dashboard

- Upon clicking "wishlist," the system will display a list of wishlist items.

- Each item will include details such as property name, user information, and date added.

101. If you would like to add a service type and/or view the list of all service types being offered, Select "Service Types"

102. Adding a Service Type from the Admin Dashboard

- Clicking "Add service type" will open a new form or modal window where administrators can input details for the new service type.

- The form include fields such as service name, description, role, and other relevant information.

103. To access "Income Types", "Expense Types" and "Transactions" Click the "Financials" menu dropdown

104. Adding Income Type from Admin Dashboard

- Clicking on "Add Income Type" will prompt a new form or dialog box to appear.

- Users can then enter details for the new income type, such as name, description, and any associated parameters or settings.

- After completing the form, submit the information to add the income type to the system.

Additional Tips:

- Ensure to provide clear and descriptive names for new income types to facilitate easy identification.

105. View all transactions by clicking "transactions" from the menu bar.

106. To view or flag a transaction, click the hamburger icon beside the selected item.

107. If you would like to add users, view the list of users and assign roles and permissions within the system , Click "User Management"

108. Adding a New User from the Admin Dashboard

- Clicking on "Add User" will prompt a new user creation form to appear.

- The form will include fields for entering user details such as username, email, password, and user role.

- Upon completing the form and submitting it, the new user will be added to the system.

109. If you would like to view property feedback, select "sell property feedback" from the menu bar.

110. Select the hamburger menu beside a user to view feedback details.

111. You may edit your account information by selecting "Settings" from the menu bar.

112. Click "Account settings" to edit your login details.

113. If you would like to update the figure for featured partners, featured properties and interest rate, click "default settings"

114. Click currency to change the currency

115. Adjusting Payments via Admin Dashboard

- Upon clicking "Payment Settings," the system will display options to adjust payment configurations.

- Users can modify settings such as payment methods, currency, or billing cycles as needed.

116. Accessing Audit Log from Admin Dashboard

- Upon clicking "Audit Log," the system will display a log of recent activities, including user actions, system changes, and security-related events.

- Users can view details such as the date and time of each event, the user responsible, and a description of the action taken.

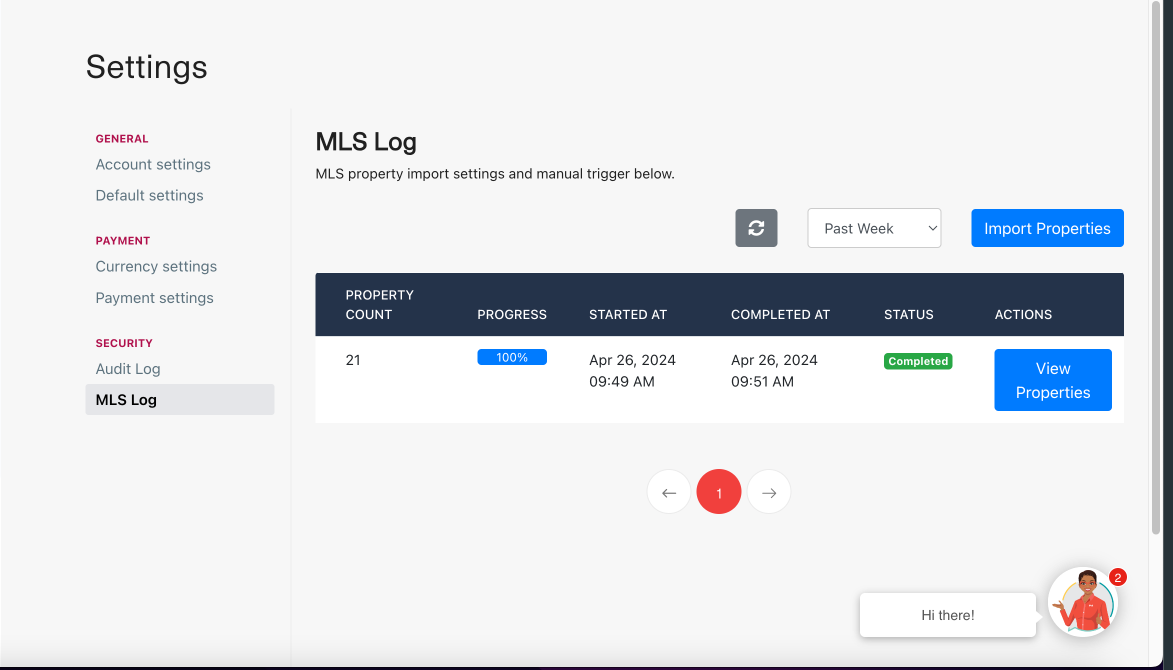

117. Accessing MLS Log from Admin Dashboard

- Upon clicking "MLS Log," the user would have to select a period first in order to import properties.

- A record would be added to the table stating the process of the import and status if its pending, completed or cancelled.

- Under the action column of the table, the user can invoke an action that will open a modal to show a list of properties that were added or existing ones that were updated.

- Clicking on the "Refresh List" button will update the progress bar and status indicators to reflect the most current data regarding property imports.

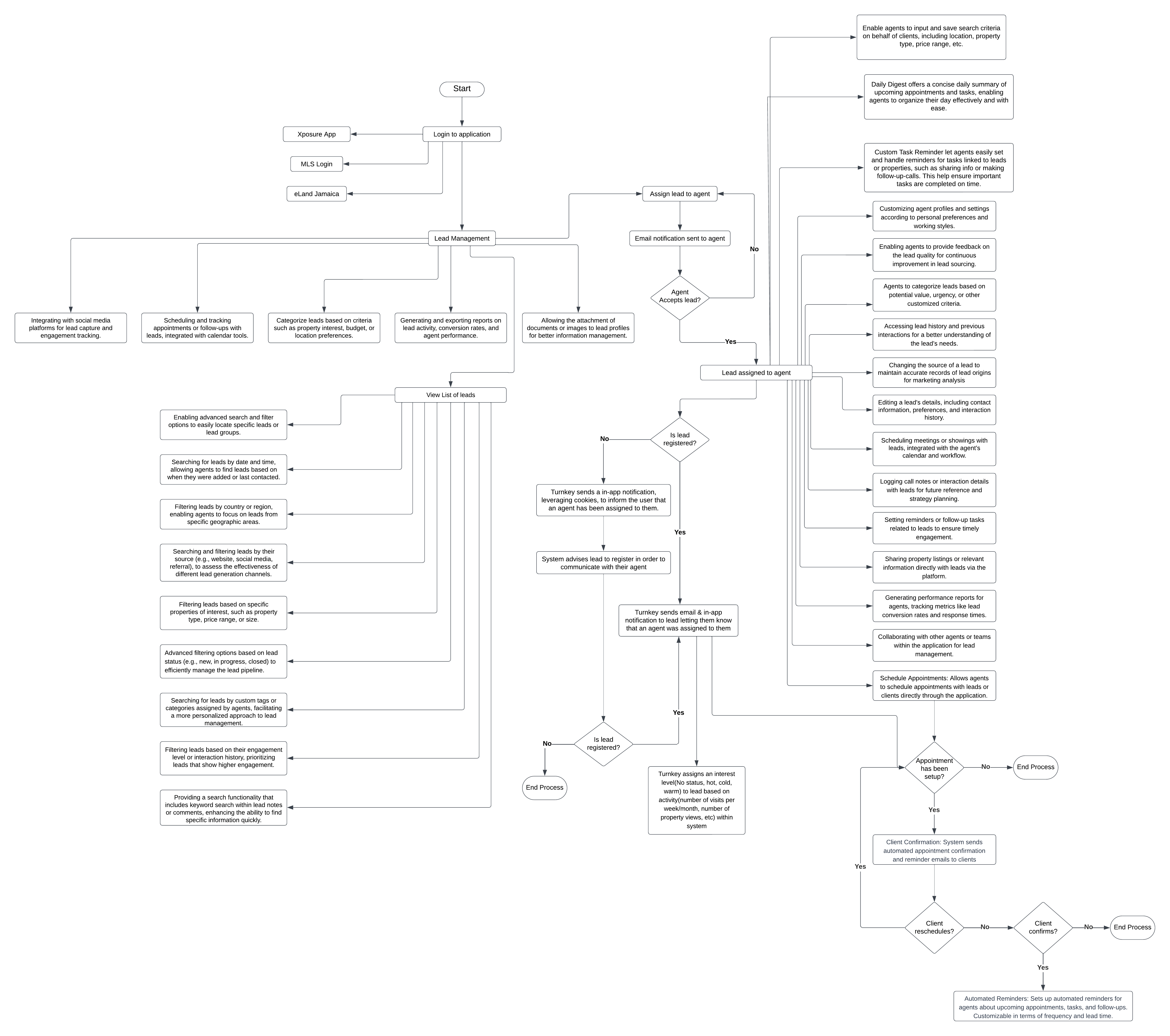

Lead Management Feature

Administration Panel

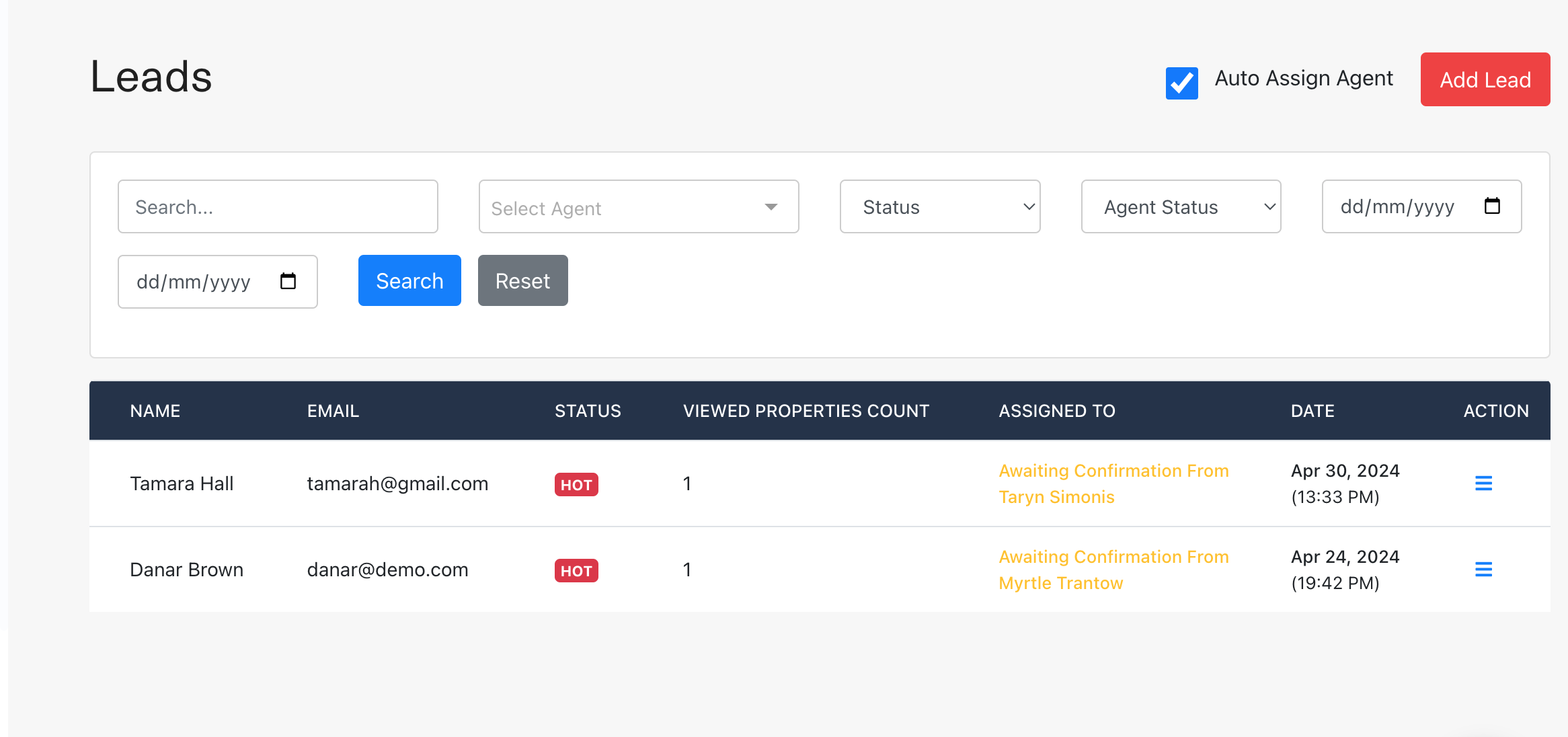

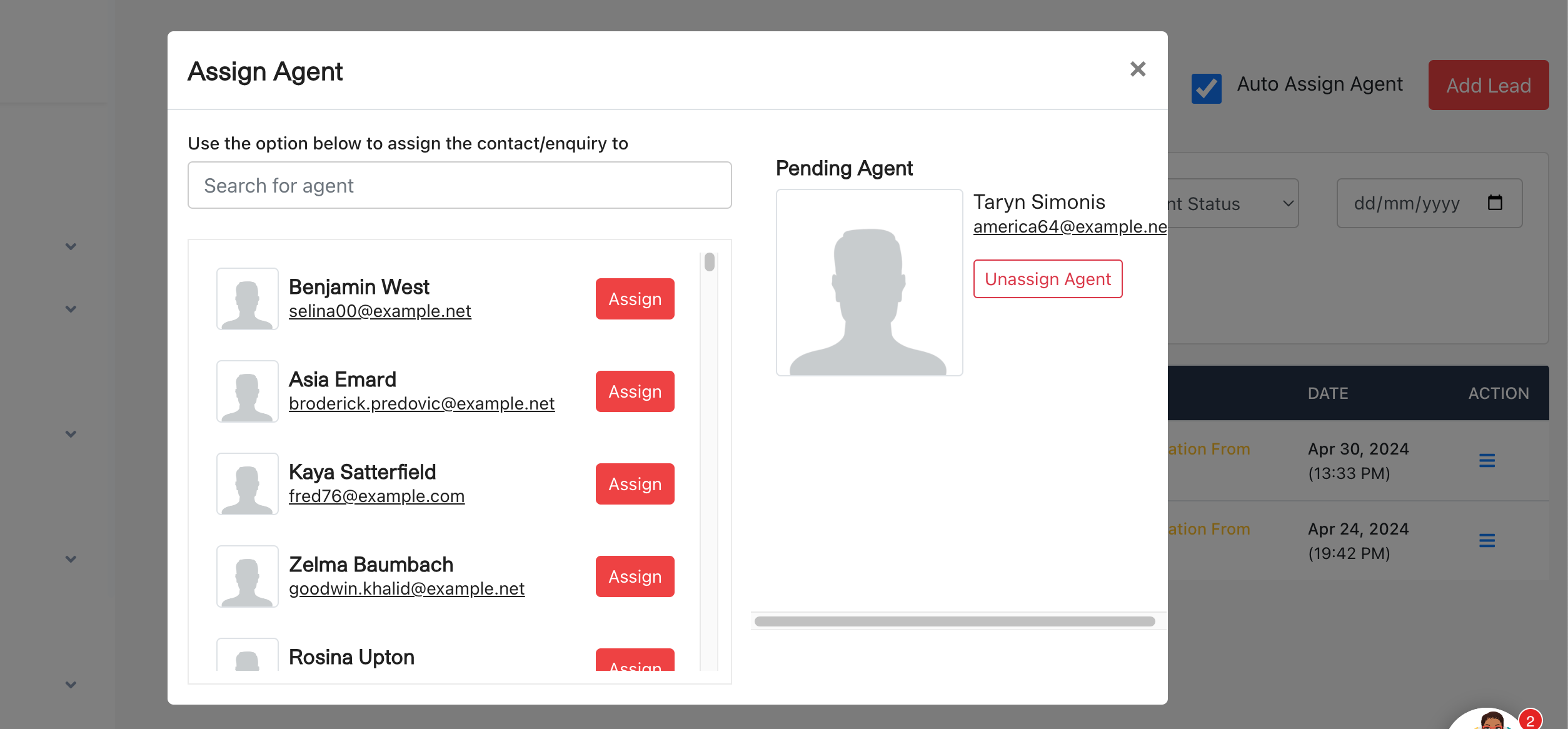

Administrators can manage leads through the admin dashboard, which provides tools for tracking, analyzing, and distributing leads among agents. Features include:

- Personal dashboard to view a list of leads, search for leads using provided filters, and manage assigned leads.

- Functionality to automatically assign agents to leads or manually assign an agent to a specific lead.

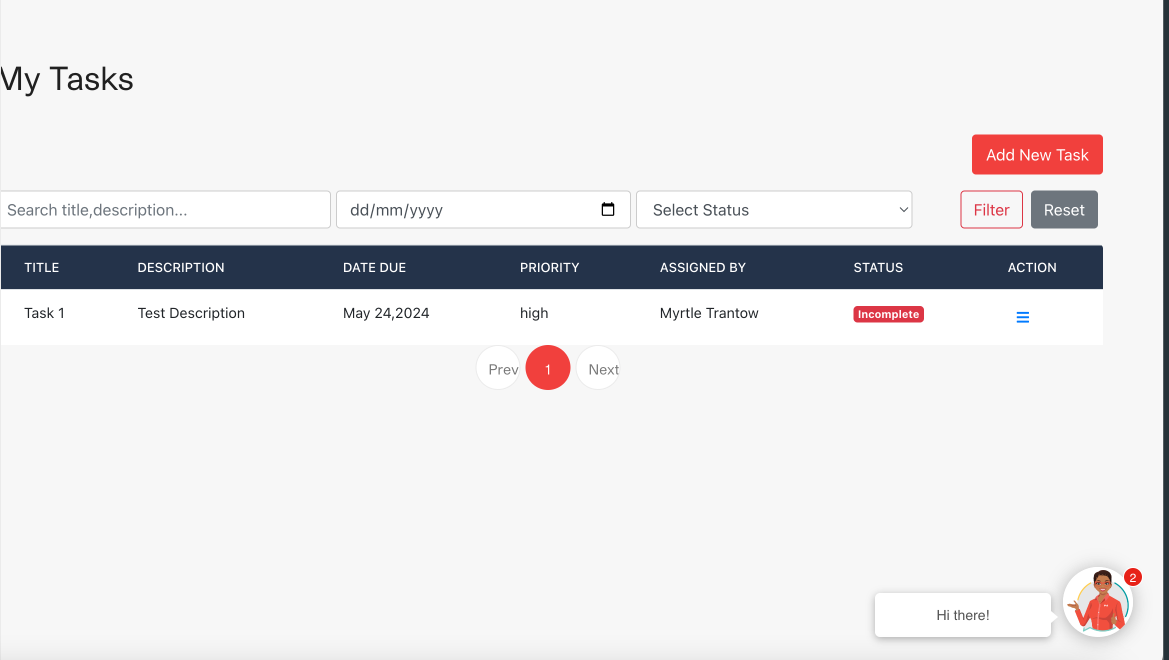

- Administrators can add and prioritize tasks for specific agents to streamline workflow management.

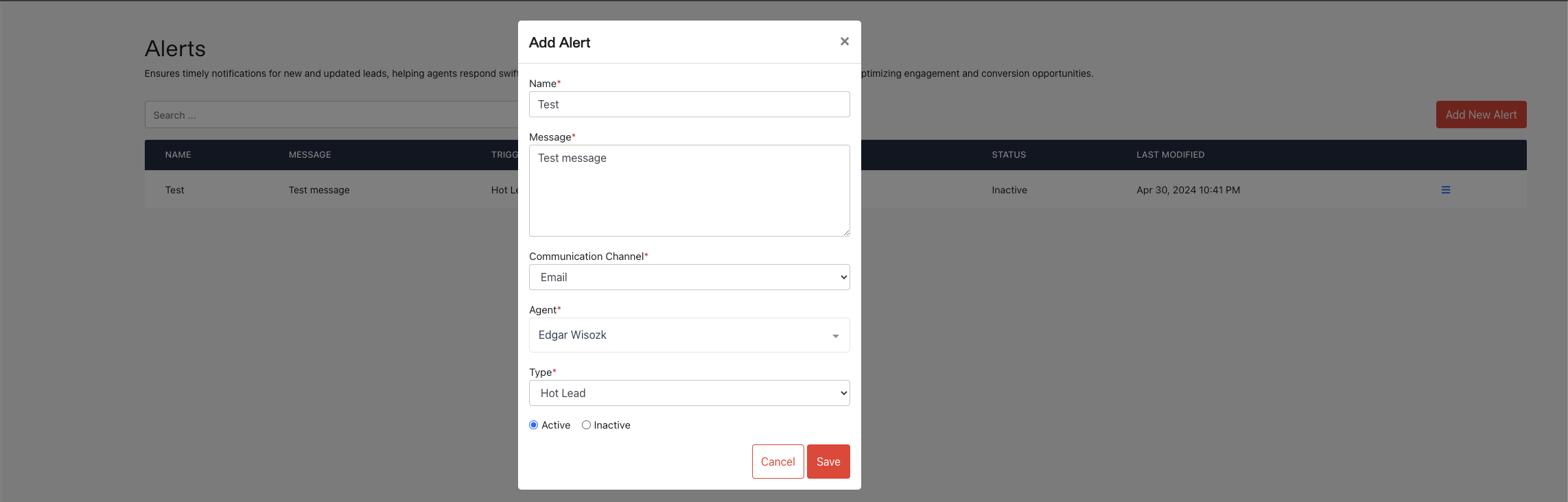

- Administrators can set up alerts to ensure timely notifications for new and updated leads, helping agents respond swiftly. These alerts track lead status changes, task deadlines, and communication needs, optimizing engagement and conversion opportunities.

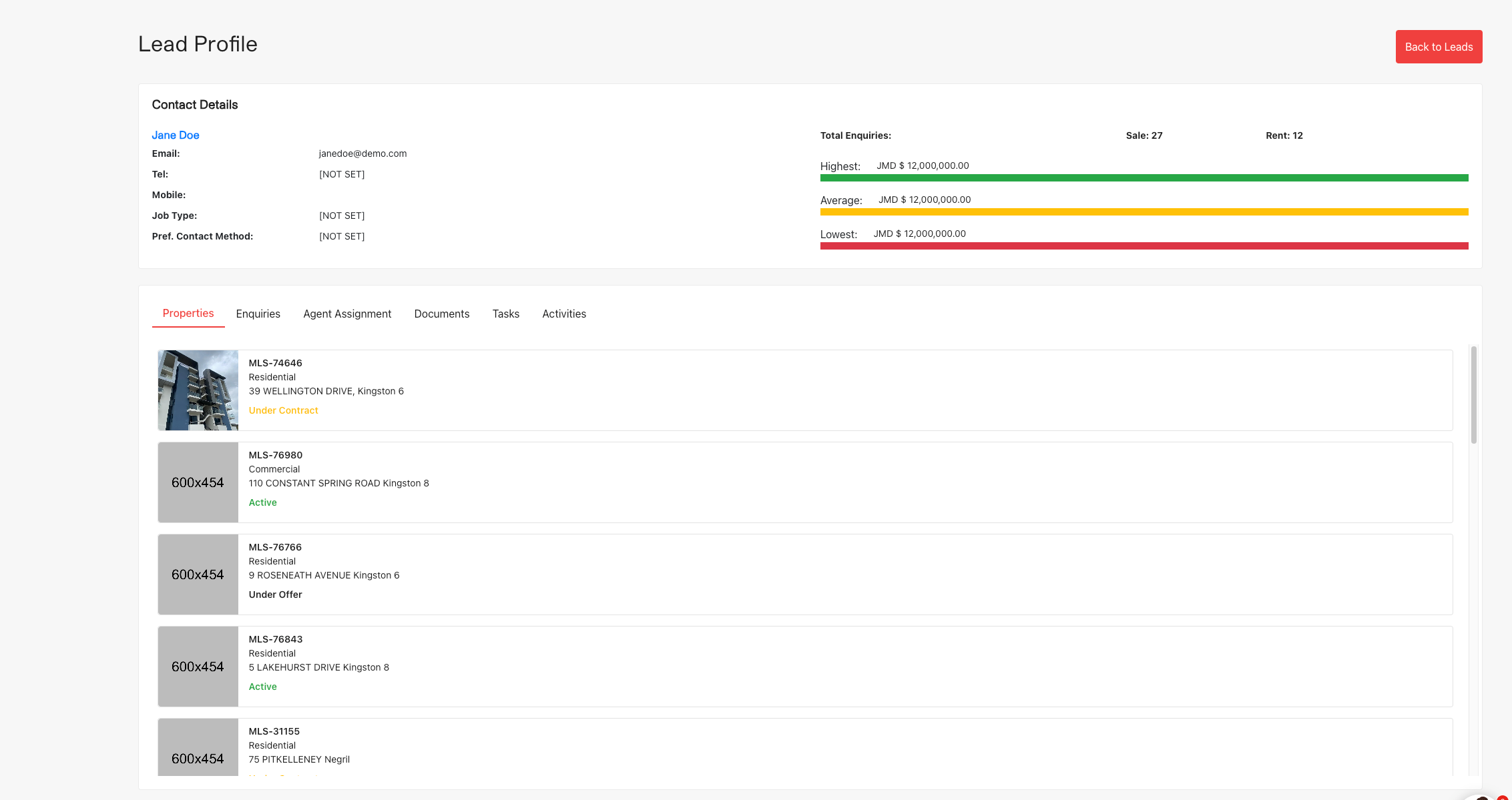

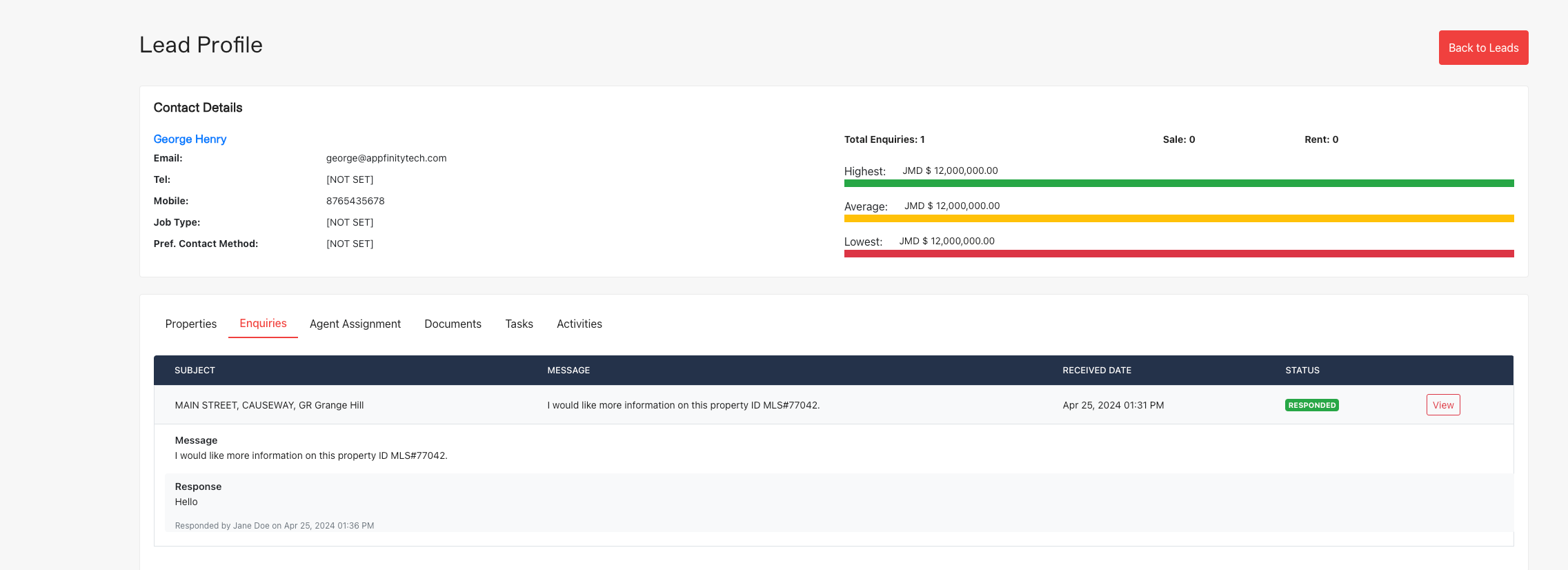

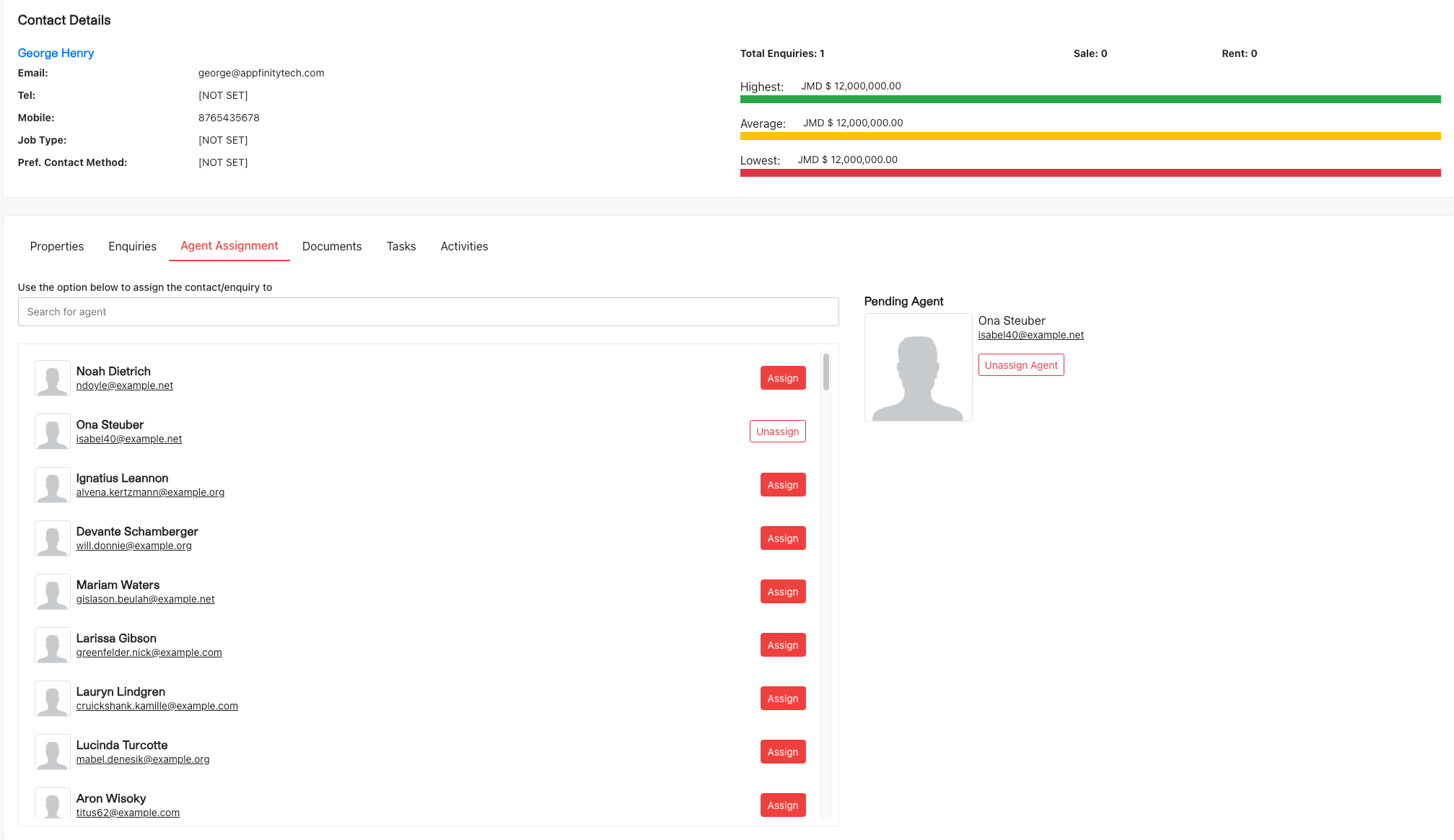

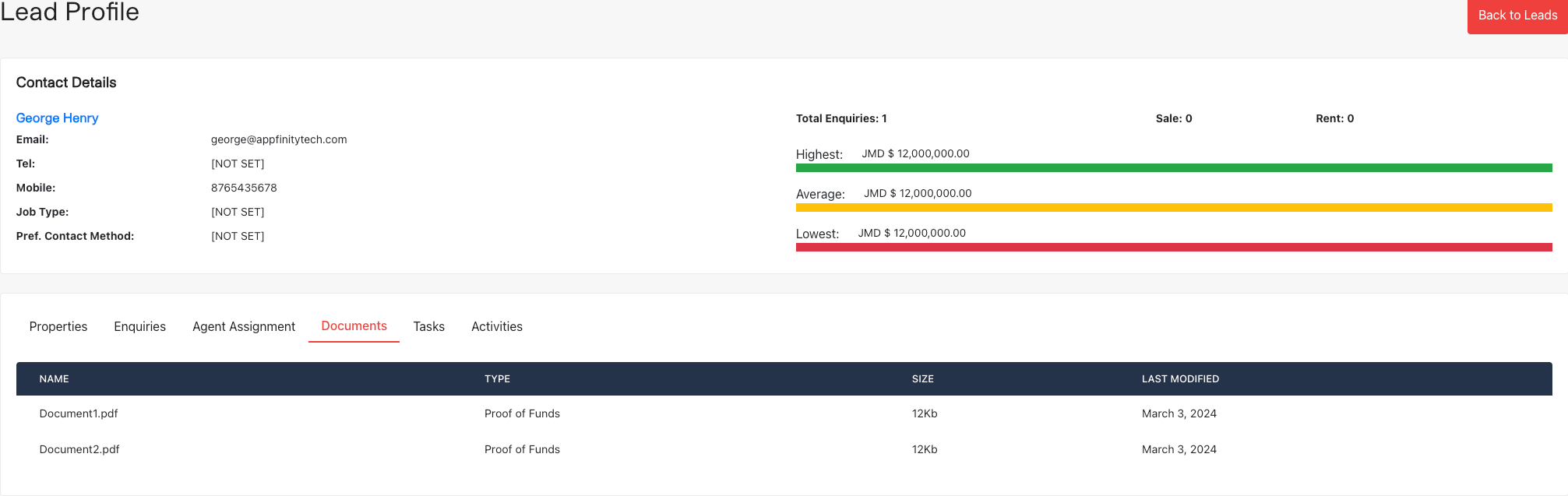

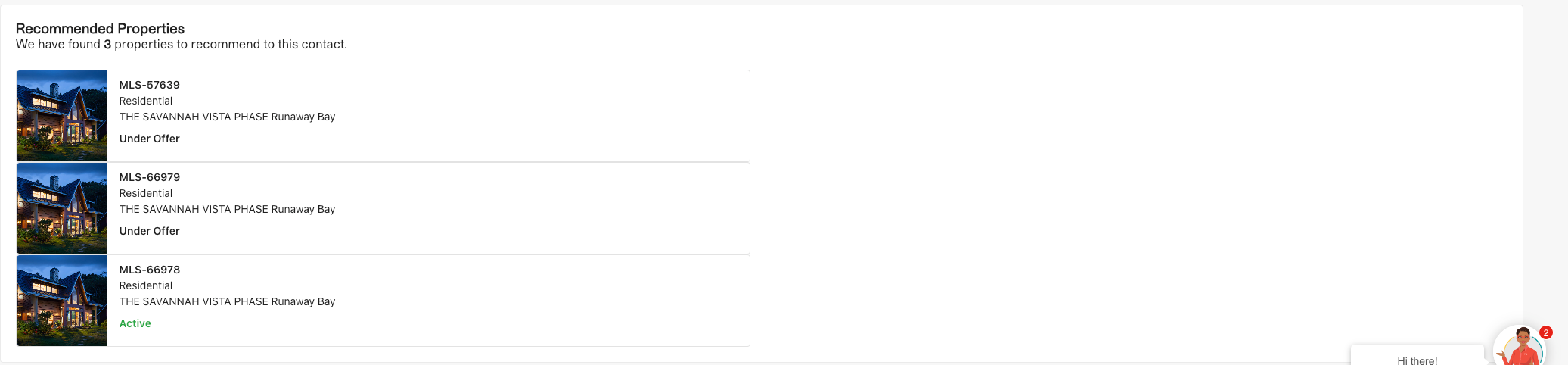

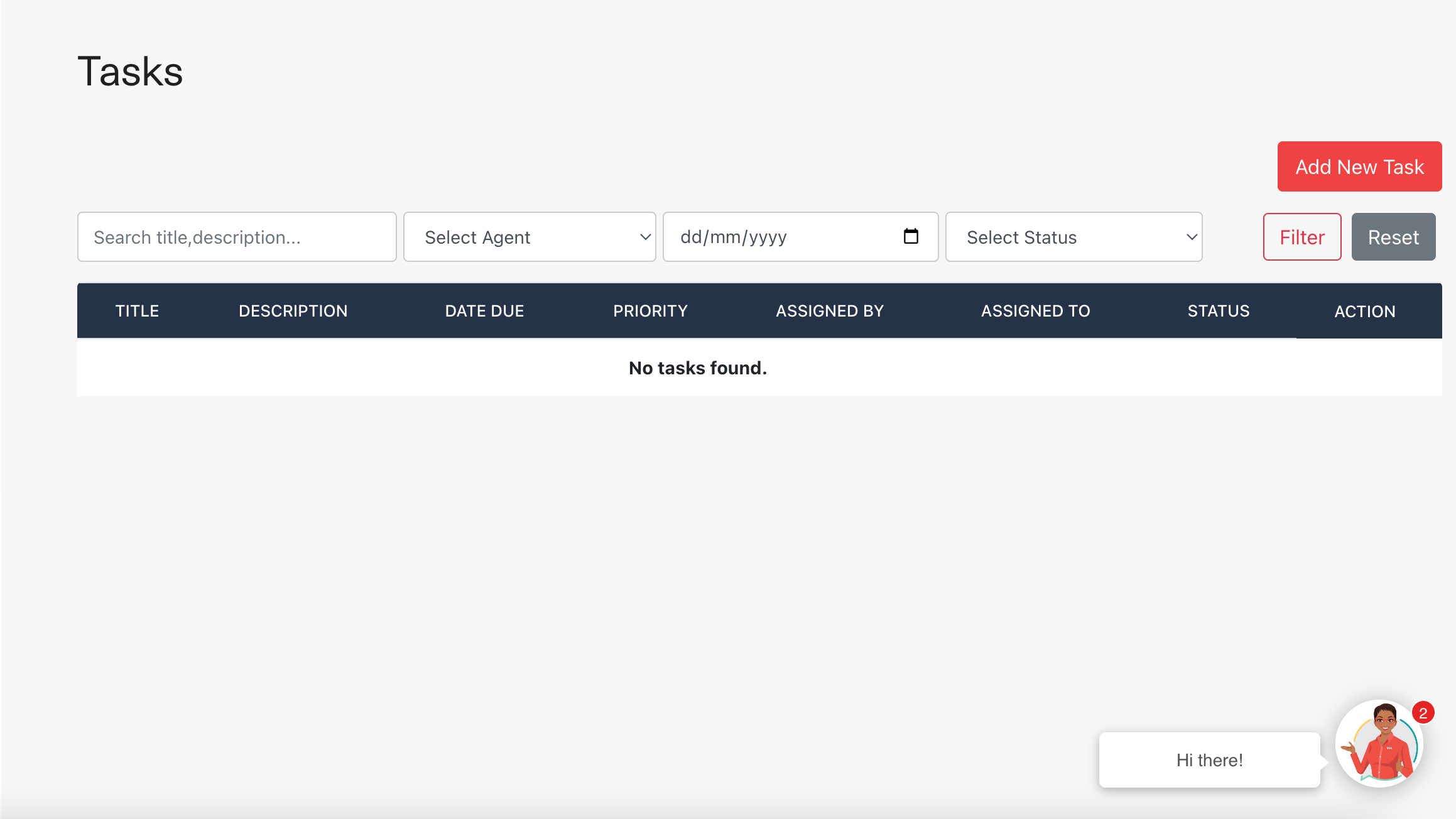

Feature Screenshots

In this section, we provide visual insights into the various features available in the lead management system. These screenshots demonstrate the functionality and user interface that administrators experience while using the system.

The Leads Table View

The Leads Profile

The lead profile is the interface where administrators can view, edit, and manage the details of a lead. This interface includes tabs for viewing the lead's properties, enquiries, assigning agents, and managing documents.

Tasks

The task interface allows administrators to create, view, and edit tasks associated with a lead. This interface includes fields for setting the task's title, description, due date, and assignee.

Alerts

This section is designed to provide timely notifications about new and updated leads, enabling agents to respond quickly and effectively. It monitors changes in lead status, upcoming task deadlines, and essential communication requirements, thereby enhancing engagement and maximizing conversion opportunities.

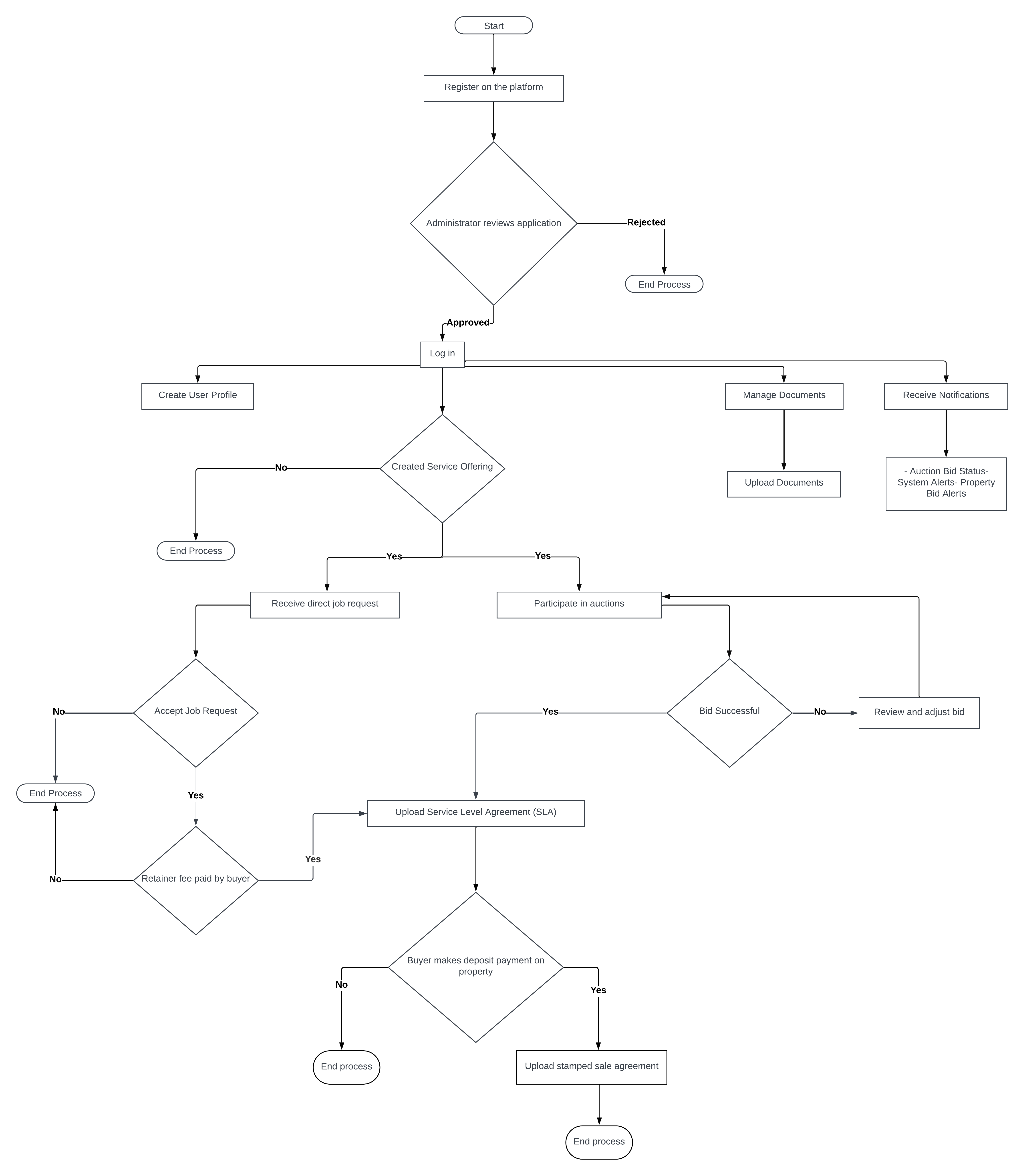

Agent Panel

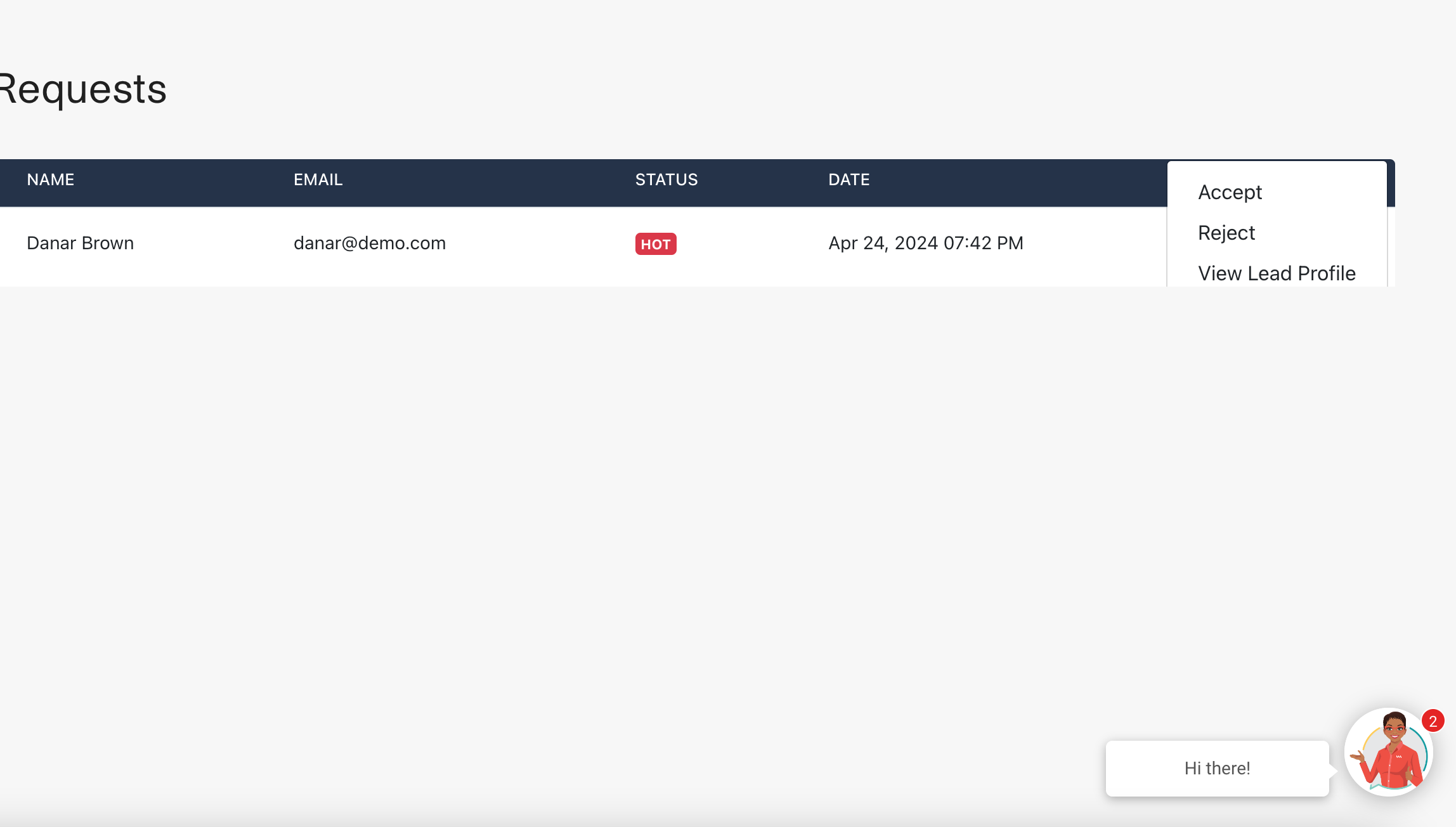

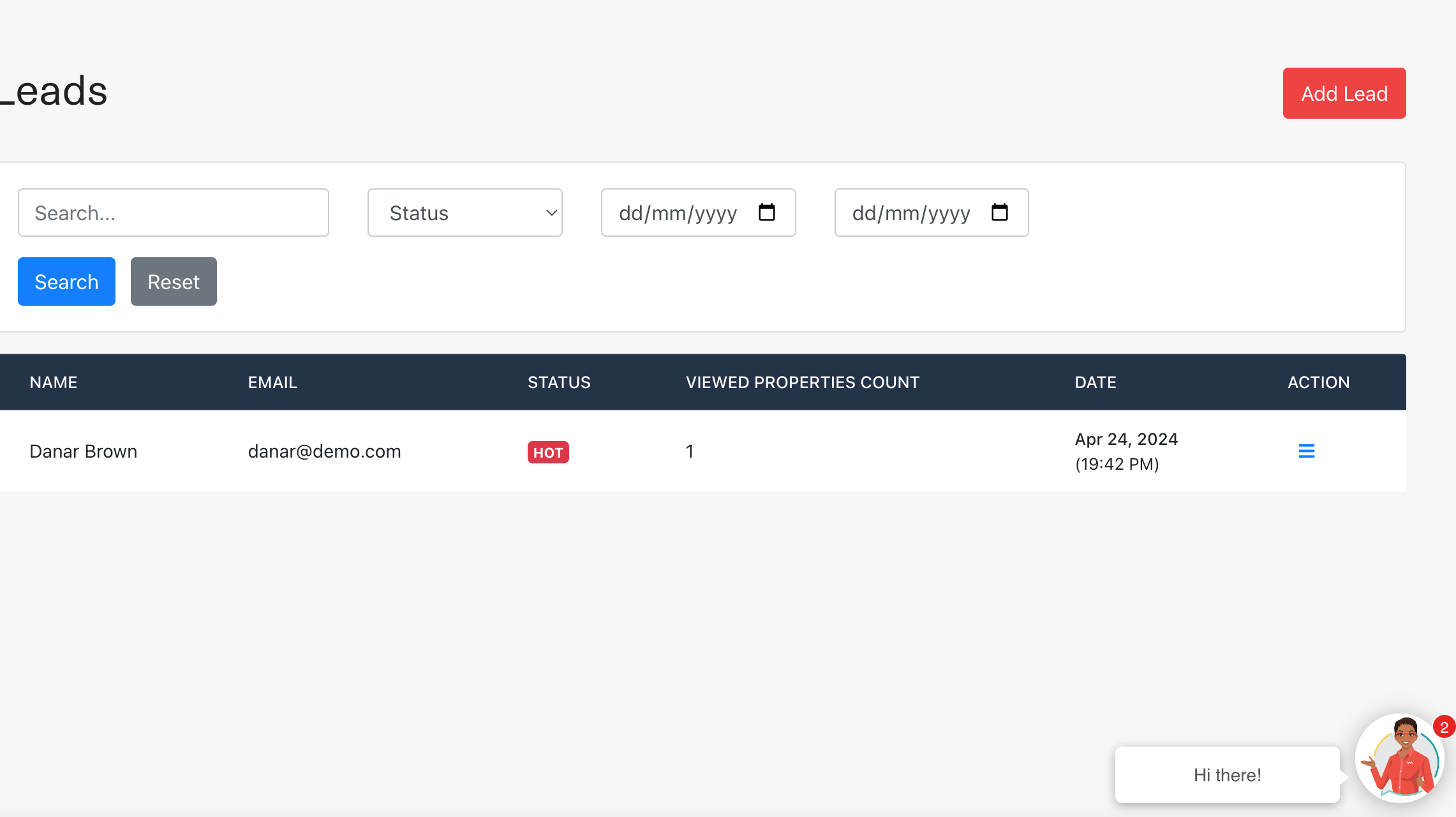

Agents access a tailored version of the lead management system, designed to streamline their workflow and enhance productivity. Features include:

- View a list of lead assignment requests sent by the administrator, which can be accepted or rejected by the agent.

- Can view a list of leads they are assigned to, add a new lead to the system, and filter out records.

- Integration with email and SMS for direct communication with leads, including the ability to create new lead-specific tasks directly from these communications.

- Can view a list of alerts to stay updated on lead interactions and preferences.

Feature Screenshots

In this section, we provide visual insights into the various features available in the lead management system. These screenshots demonstrate the functionality and user interface that agents experience while using the system.

Requests

Leads

Tasks

Installation and Development Guide

Server Requirements - Both API and NUXT facing application

The Clearing House system was built using the Laravel architecture, this framework has the following system requirements. In order for a successful installation your server should meet the following requirements:

Recommended Server: UBUNTU / LINUX

- Ubuntu 18.04 or Higher

- Apache2

- PHP >= 7.0

- OpenSSL PHP Extension

- PDO PHP Extension

- Mbstring PHP Extension

- Tokenizer PHP Extension

- XML PHP Extension

- Ctype PHP Extension

- JSON PHP Extension

- MYSQL >= 5.7

- Composer >= V1

General Base Server Spec: UBUNTU / LINUX

- Memory: 2GB

- vCPUs: 2vCPUs | 1 Dedicated CPU

- Transfer: 3TB

- SSD Disk: 60GB

- Bk/UP: Daily

Once you have configured your server to the specifications above, do the following:

- Go to the Clearing House repository or your Dropbox folder.

- Clone or Download it to your web server root.

- Suppose, you kept the cloned/downloaded files in the main directory.

- Go to your Laravel directory (in Ubuntu Linux, it will be /var/www/Clearing_House).

- Run the following command -> Composer Install.

This will install the required dependencies to run Laravel. It will take some time to install all the dependencies.

If you are on Linux then you should also set write permission to bootstrap/cache and storage directories.

Here’s the command to do so:

sudo chmod -R 777 bootstrap/cache storage

Database Setup and Laravel Configuration

- Download and install MySQL.

- Set up your host, username, and password configuration.

- Create a new blank database “let's call it Clearing_House_tracker”.

After this, you should be able to browse your Clearing House site. If you get a ‘No encrypter found’ error, then it means that your site’s encryption key has not been generated yet.

Generate Encryption Key

- Go to your Clearing House directory.

- Rename .env.example to .env.

- Now, open terminal or command-prompt.

- Run the following command:

php artisan key:generate

You will see the message on the terminal saying application key set successfully. This will update the .env file present in your Laravel root folder. In that file, it will set the value of APP_KEY. This will solve the error, and now you should be able to browse the site properly.

Migrating and Seeding the Database

- Open the .env file you renamed earlier.

- Set your database connections as seen below:

DB_CONNECTION=mysql

DB_HOST=localhost

DB_PORT=3306

DB_DATABASE="your database name"

DB_USERNAME="your MySQL username"

DB_PASSWORD="your MySQL password"

Once that is complete, run the following commands:

-

php artisan migrate

- this will migrate your database. -

php artisan db:seed

- this will seed all the tables with the necessary configurations for Clearing House to work properly.

Now, you should be able to access Clearing House properly without any error, e.g., http://localhost/Clearing_House-tracker/public.

Setting up Email Gateway

The application can use any email provider to execute on sending transactional emails to visitors as well as other users of the system. Below are the fields required:

MAIL_DRIVER=smtp

MAIL_HOST=smtp.mailtrap.io

MAIL_PORT=2525

MAIL_USERNAME=null

MAIL_PASSWORD=null

MAIL_ENCRYPTION=null

Migrating and Seeding Your Database and Default Users

To migrate your database from the command line, run the following commands:

php install --no-interaction --prefer-dist --optimize-autoloader

php artisan migrate --force

php artisan db:seed --force

Setting the Base URL and Nuxt URL in the .env File

In the .env file, set the following to your domain as follows:

APP_URL="https://api.yourdomain.com"

SESSION_DOMAIN=.yourdomain.com

SANCTUM_STATEFUL_DOMAINS=yourdomain.com

Installing and Deploying NUXT JS to Your Server

- On a second server, install the following version of node and npm using

apt-get install nodejs npm

- Verify the versions:

- npm -v 6.14.15

- node -v v14.17.6

- Create a directory, for example,

/var/www/html/

, and pull the code from the repository. - Next, run the following commands to pull in all the required packages:

npm install

npm run build

- Change your IP address in the config file.

- Set up Nginx by installing it and configuring your site:

-

apt-get install nginx

- Type Y when prompted - Edit the Nginx site configuration:

nano /etc/nginx/sites-available/my.app

- Paste the following configuration, replacing the server_name with

your Droplet IP:

server { listen 80; listen [::]:80; index index.html; server_name your_server_ip; # Replace with your Droplet IP location / { proxy_pass http://localhost:3000; proxy_http_version 1.1; proxy_set_header Upgrade $http_upgrade; proxy_set_header Connection 'upgrade'; proxy_set_header Host $host; proxy_cache_bypass $http_upgrade; } } - Save the configuration file and create a symbolic link to the Nginx

'sites-enabled' directory:

ln -s /etc/nginx/sites-available/my.app /etc/nginx/sites-enabled/

- Test the Nginx configuration:

nginx -t

If the output indicates everything is ok, proceed to the next step. - Restart Nginx to apply the changes:

service nginx restart

-

- Install PM2 to manage your application process:

npm install pm2 -g

- The -g flag installs PM2 globally. - Start your application using PM2 from the project root folder:

pm2 start npm -- start

Helpful Links:

Importing Properties

- Setup Horizon by creating a server daemon that executes the

php artisan horizon

command from your site's root directory. - Add the

php artisan horizon:terminate

command to your site's deployment script, as described in Horizon's documentation. - For more information, see Laravel Horizon documentation.

Setup Server Environment

- Navigate to the “.env” file in the root folder of the project or create one if it doesn't exist.

- Ensure the “.env” file has

RETS_USERNAME={YOUR_RETS_USERNAME}andRETS_PASSWORD={YOUR_RETS_PASSWORD}. Add or update accordingly.

Import Currency Information

- Type

php artisan scrape:currency

in the root folder of the terminal. Press enter to begin scraping currency information. - This will start importing currency information. To confirm that this process was completed check /horizon of the domain used for the backend.

- The currency information is imported includes the name of the currency alongside the buying and selling price compared to Jamaican Dollars (JMD)

Import The Properties

- Type

php artisan import-properties

in the root folder of the terminal. Press enter to begin importing properties. - This will start importing MLS properties, which will take some time to complete. The status of processes responsible for importing the properties can be viewed at /horizon of the domain used for the backend.

Import External Agents

- Type

php artisan import:external-agents

in the root folder of the terminal. Press enter to begin importing external agents. - This will start importin RAJ certified agents, some of whom may be responsible for listing the properties imported above. The status of processes responsible for importing the properties can be viewed at /horizon of the domain used for the backend.

Daily Imports

Type

php artisan queue:workin the root folder of the terminal. Press enter to begin importing properties daily and import currency information daily.

Setting up Email Gateway

Below are the fields required for setting up any email provider to send transactional emails:

MAIL_DRIVER=smtp

MAIL_HOST=smtp.mailtrap.io

MAIL_PORT=2525

MAIL_USERNAME=null

MAIL_PASSWORD=null

MAIL_ENCRYPTION=null

Migrating and Seeding Your Database and Default Users

To migrate your database and seed default users, run the following commands from the command line:

php install --no-interaction --prefer-dist --optimize-autoloader

php artisan migrate --force

php artisan db:seed --force

Setting the Base URL and Nuxt URL in the .env File

Set the following in your .env file to configure your domain:

APP_URL="https://api.yourdomain.com"

SESSION_DOMAIN=.yourdomain.com

SANCTUM_STATEFUL_DOMAINS=yourdomain.com

Following these steps will ensure the Clearing House system is properly set up and configured, ready for use. For any further assistance, consult the provided helpful links or reach out to the support team.

Testing Documentation

Table of Contents

- Test Case #1: TC_REALTOR_USER_001 - Add City/Town to Property Listing

- Test Case #2: TC_REALTOR_USER_001 - Create Property (Updated)

- Test Case #3: TC_GUEST_USER_002 - Filter Property Search Results by Number per Page with One Click

- Test Case #4: GUESTUSER 002 - Filter Property Search Results Price in Ascending/Descending Order

- Test Case #5: TC_SYSTEM_ADMINISTRATOR_USER - Import Properties Listed on MLS

- Test Case #6: TC_SYSTEM_ADMINISTRATOR_USER - Update Previously Imported Properties Listed on MLS and Import New Ones

- Test Case #7: TC_GUEST_USER_002 - Search and Filter Properties

- Test Case #8: TC_GUEST_USER_002 - Calculate Mortgage Costs

- Test Case #9: TC_PURCHASER_001 - Verify Logged-in Purchaser Cannot Create Property

- Test Case #10: TC_REALTOR_001 - Filter Buyer’s Source of Funds by Status

- Test Case #11 (First Instance): TC_LAWYER_001 - Lawyer Uploads Sales Agreement and Instrument of Transfer

- Test Case #11 (Second Instance): TC_PURCHASER_002 - Purchaser Generates Offer to Purchase

- Test Case #12: TC_VALUATOR_001 - Valuator Uploads Valuation Report After Job Acceptance and Payment

- Test Case #13: TC_SURVEYOR_001 - Surveyor Uploads Report After Job Acceptance and Payment

Test Plan for VMI TurnKey Platform

Document Version: 1.0

Date: Feb 22 2024

Author: AppFinityTechnologies

1. Introduction

This test plan document provides an overview of the testing strategy and objectives for the Real Estate Platform. It outlines the test cases to be executed to validate the functionalities of property listing, searching, user management, and system integrations.

2. Test Objectives

- To verify that the property listing feature allows realtors to add new properties with accurate details.

- To ensure the property search functionality works as expected, providing users with relevant results based on their queries.

- To validate user role-based access control for different functionalities within the platform.

- To assess the system's ability to import and update property listings from external MLS sources.

3. Scope

The testing scope includes:

- User Interface testing for property listing and search functionalities.

- Backend API testing for user management, property listing, and search services.

- Integration testing with external MLS services for property data import.

- Security testing for user authentication and authorization.

4. Test Strategy

The testing will be conducted in the following phases:

- Unit Testing: Individual components will be tested for expected functionality.

- Integration Testing: Combined parts of the application will be tested to ensure they work together as expected.

- System Testing: The complete integrated system will be tested to verify that it meets all requirements.

- Acceptance Testing: The system will be tested in a real-world scenario to ensure it meets the user's needs.

5. Test Environment

The tests will be carried out in a controlled development environment with a configuration that mimics the production setup. This includes:

- Web and application servers

- Database server

- Test data

- Access to external MLS services for integration testing

6. Test Cases

Refer to the Test Cases section for a detailed list of all the test cases to be executed, including their objectives, steps, expected outcomes, and actual results.

7. Exit Criteria

Testing will conclude when the following criteria are met:

- All test cases have been executed.

- All critical bugs have been fixed and verified.

- The overall success rate of test cases exceeds 95%.

- Acceptance testing has been successfully completed with stakeholder approval.

8. Risks and Mitigation

- Risk: Integration with external MLS services may face unexpected issues. Mitigation: Work closely with service providers to ensure compatibility and have a contingency plan in place.

9. Approval

The test plan will be reviewed and approved by VMI stakeholders before execution.

Test Scripts

Test Case #1: TC_REALTOR_USER_001

Objective: Add City/Town to Property Listing

Author: Rushane Kerr

Pre-Conditions:

- The User is Registered as a Realtor

- The User is logged on

Test Steps:

- Go to ‘/profile/sell-properties/create’

- Select a Parish, this will then show the Towns/City Field with a list of towns and cities generated

- Select a town or city for the location of the property

Expected Output:

- Selecting a parish Should auto-generate a City/Town field with a set of Cities/Towns to choose from which the user may now select from

- Towns and Cities field should be cleared and new set generated if a new parish is selected

Actual Output: Selecting A Parish Created a City/Town Field with cities/towns to choose from

Test Case #2: TC_REALTOR_USER_001 (Create Property Updated)

Objective: Create Property (Updated)

Author: Rushane Kerr

Pre-Conditions:

- The User is Registered as a Realtor

- The User is logged on

Test Steps:

- Go to ‘/profile/sell-properties/create’

- To add a town or city see Test Case #1

- Type or select the values accordingly, validation is in place to ensure values are in the correct format

- Click The Save Changes button at bottom right of the page

Expected Output:

- A new property listing with the status of inactive will be created

Actual Output: A new property was created with the fields I entered being editable. The status was set to inactive.

Test Case #3: TC_GUEST_USER_002

Objective: Filter Property Search Results by number per page with one click

Author: Rushane Kerr

Pre-Conditions:

- There are properties within the database where the status is not (inactive)

- The User is either a guest or is logged-in

Test Steps:

- Go to /properties

- Select the amount of results per page you want to see on the right-most drop-down on the white bar that lists the amount of search results

Expected Output:

- The list of results on the page should be equal to or less than value selected depending on how many search results were returned

Actual Output: The results on the page were equal to or less than the selected value

Test Case #4: GUESTUSER 002

Objective: Filter Property Search Results price in ascending/descending order

Author: Rushane Kerr

Pre-Conditions:

- There are properties in the database where the status is not (inactive)

- The User is either a guest or is logged-in

Test Steps:

- Go to /properties

- Select the option Low/High (ascending) or High/Low (descending) on the second to right-most drop-down on the white bar that lists the amount of search results

Expected Output:

- The list of results on the page should be ordered by price values based on the order that was selected

Actual Output: The results on the page were ordered accordingly ascending order when (Low/High) was selected and descending order when (High/Low) was selected

Test Case #5: TC_SYSTEM_ADMINISTRATOR_USER

Objective: Import Properties Listed on MLS

Author: Rushane Kerr

Pre-Conditions:

- User has SSH access to the back-end that hosts the “VMI Backend” Repository

- User is familiar with Laravel Horizon

- Laravel Horizon is active and running

Test Steps:

- Go to the .env file in the root folder of the server currently hosting the “VMI Backend” Repository. Create one if it does not exist.

- Ensure that the .env file has RETS_USERNAME={YOUR_RETS_USERNAME} and RETS_PASSWORD={YOUR_RETS_PASSWORD}. Add accordingly or update if it is not there or it is incorrect.

- Type “php artisan import-properties” in the root folder of the terminal of the server that is currently hosting the “VMI Backend” Repository.

Expected Output:

- By going to /horizon of the backend hosting address, the user can view the jobs in progress, completed, etc.

- As jobs are in progress/completed by going to /properties of the front-end hosting address, the user can see the successful importation of properties, a maximum 50 at a time per job completed.

Actual Output: Properties are imported by maximum 50 per each job successfully completed.

Test Case #6: TC_SYSTEM_ADMINISTRATOR_USER (Update previously Imported Properties Listed on MLS and Import New Ones)

Objective: Update previously Imported Properties Listed on MLS and Import New Ones

Author: Rushane Kerr

Pre-Conditions:

- User has SSH access to the back-end that hosts the “VMI Backend” Repository.

- User is familiar with Laravel Horizon.

- Laravel Horizon is active and running.

Test Steps:

- Go to the .env file in the root folder of the server currently hosting the “VMI Backend” Repository. Create one if it does not exist.

- Ensure the .env file has RETS_USERNAME={YOUR_RETS_USERNAME} and RETS_PASSWORD={YOUR_RETS_PASSWORD}. Add accordingly or update if it is not there or incorrect.

- Type “php artisan queue:work” if worker isn't already running in the root folder of the terminal of the server that is currently hosting the “VMI Backend” Repository.

Expected Output:

- Based on daily activity on MLS existing properties should be updated and new ones created (this information can be checked by viewing the created_at/updated_at values of properties in the database).

Actual Output: Properties with modification dates post initial import date were either newly added or updated if they were already in the database.

Test Case #7: TC_GUEST_USER_002 (Search and Filter Properties)

Objective: Search and Filter Properties

Author: Rushane Kerr

Pre-Conditions: There are properties in the database without the status “inactive”.

Test Steps:

- Navigate to the home page or any page that has the vertical search and filter feature.

- On the home page, scroll to the form field directly after the site summary.

- Click on the buttons to select the category of the property you are looking for. The button with a “red (grapefruit)” color background will determine the category of the results returned.

- On The form below, there is one text field and the rest are select fields. Select any number of combinations available to search for (1 at a time only for each field).

- The text field requires you to type in information, however, this field is only useful if you type in an existing MLS number; otherwise, the number of results returned will always be zero.

- Click the “Search” button to search for properties or “Reset” button to clear the fields and return to the default state.

Expected Output:

- The user should be navigated to /properties page with the number of results shown and only a list of properties that matches the search criteria.

- Zero to One property result(s) should be returned if the MLS field was utilized in the search.

Actual Output: Navigated to /properties page with the number of results and a list of properties shown matching the search criteria.

Test Case #8: TC_GUEST_USER_002 (Calculate Mortgage Costs)

Objective: Filter Property Search Results price in ascending/descending order

Author: Rushane Kerr

Pre-Conditions:

- There are properties in the database where the status is not (inactive)

- The User is either a guest or is logged-in

Test Steps:

- Go to /properties

- Select the option Low/High (ascending) or High/Low (descending) on the second to right-most drop-down on the white bar that lists the amount of search results

Expected Output:

- The list of results on the page should be ordered by price values based on the order that was selected

Actual Output: The results on the page were ordered accordingly ascending order when (Low/High) was selected and descending order when (High/Low) was selected

Test Case #9: TC_PURCHASER_001

Objective: To verify that a logged-in purchaser cannot create a property

Author: Xanius Hall

Pre-Conditions:

- The user is registered on the platform with the role of “Buyer”

- The user is already logged on

Test Steps:

- Log in with the purchaser account details

- Navigate to the section of the page where property creation is usually available, which is the dashboard menu option that says “Sell Properties”

Expected Output:

- The “Sell Properties” link should not be visible to the logged-in purchaser

- If the purchaser tries to navigate to the property creation directly (via profile/sell-properties), they should be redirected to the dashboard page

Actual Output: The “Sell Properties” link was not visible to the logged-in purchaser. When the purchaser attempted to navigate directly to the property creation page (via profile/sell-properties), they were redirected to the dashboard page

Test Case #10: TC_REALTOR_001

Objective: To verify that the realtor can filter the “Buyer’s Source of Funds” by status (Submitted, Approved, Rejected).

Author: Xanius Hall

Pre-Conditions:

- User is registered as a Realtor on the platform.

- User is logged in.

- There is an existing transaction with various statuses.

Test Steps:

- Log in with the realtor account.

- Navigate by clicking 'Sell Properties' on the dashboard menu and select a transaction from the data table.

- Locate the ‘Buyer’s Source of funds filter”.

- Select the status ‘Submitted’ from the filter.

- Observe the transaction list.

- Change the filter to 'Approved'.

- Observe the transaction list.

- Change the filter to 'Rejected’.

- Observe the transaction list.

Expected Output:

- When the 'Submitted' status is selected, only transactions with the source of funds marked as 'Submitted' should be displayed.

- When the 'Approved' status is selected, only transactions with the source of funds marked as 'Approved' should be displayed.

- When the 'Rejected' status is selected, only transactions with the source of funds marked as 'Rejected' should be displayed.

Actual Results: When a user selected the 'Submitted' status, the transactions with the source of funds marked as 'Submitted' were displayed. When a user selected the 'Approved' status, the transactions with the source of funds marked as 'Approved' were displayed. When a user selected the 'Rejected' status, the transactions with the source of funds marked as 'Rejected' were displayed.

Test Case #11: TC_LAWYER_001

Objective: To verify that a lawyer can upload a Sales Agreement and Instrument of Transfer for a property transaction after accepting a job request and after the client has made the payment.

Author: Xanius Hall

Pre-Conditions:

- User is registered as a Lawyer on the platform.

- A job request has been sent to the lawyer by a user seeking legal services.

- Lawyer is logged in.

Test Steps:

- Log in with the lawyer account using the username and password.

- Navigate to the Job Request section by clicking “My Request” on the dashboard menu.

- Locate the job request and click “Accept” to accept the job request.

- Log in as the purchaser and make payment for the service on the property transaction. Go to the 'Assign Attorney' tab.

- Confirm that the offer to purchase the property has been accepted by the realtor.

- Navigate to the Legal Documents tab for the property transaction.

- Upload the Sales Agreement and Instrument of Transfer documents.

Expected Output:

- The lawyer should be able to see and accept the job request.

- After accepting, the user should be prompted to make a payment.

- Once the payment is made, the offer to purchase should be accepted by the realtor.

- The Sales Agreement and Instrument of Transfer should be successfully uploaded and saved in the system.

Actual Output: The lawyer was able to see and accept the job request. After accepting, the user was prompted to make a payment. After the payment was made, the offer to purchase was accepted by the realtor. The Sales Agreement and Instrument of Transfer were successfully uploaded and saved in the system.

Test Case #12: TC_VALUATOR_001

Objective: To verify that the valuator can upload a valuation report after accepting a job request and receiving payment from a user who is purchasing a property.

Author: Xanius Hall

Pre-Conditions:

- The valuator is registered on the platform.

- The valuator has received a job request from a user for property valuation.

- The valuator and the user are logged in.

- The user has reached the "Property Valuation Report" step in their property transaction flow.

Test Steps:

- Log in with the valuator account using username.

- Navigate to the 'My Requests' view.

- Accept the job request from the user.

- Verify in the system that the user has made the payment under the "Property Valuation Report" step.

- Navigate to 'My Requests' and go to the 'Delivery' tab.

- Upload the valuation report.

- Check if the job status is marked as complete.

Expected Output:

- Valuator should be able to accept the job request.

- System should confirm that the user has made the payment.

- 'Upload' button should be available under the 'Delivery' tab.

- Valuation report should be uploaded successfully.

- The user should be able to download the uploaded report from their "Property Valuation Report" tab.

- The job should be marked as complete.

Actual Output: The valuator accepted the job request. The system confirmed that the user made the payment. The 'Upload' button was available under the 'Delivery' tab. The valuation report was uploaded successfully. The user was able to download the uploaded report from their "Property Valuation Report" tab. The job was marked as complete.

Test Case #13: TC_SURVEYOR_001

Objective: To verify that the surveyor can upload a report after accepting a job request and receiving payment from a user who is purchasing a property.

Author: Xanius Hall

Pre-Conditions:

- The surveyor is registered on the platform.

- The surveyor has received a job request from a user for a surveyor report.

- The surveyor and the user are logged in.

- The user has reached the "Surveyor Report" step in their property transaction flow.

Test Steps:

- Log in with the surveyor account using the username.

- Navigate to the 'My Requests' view.

- Accept the job request from the user.

- Verify in the system that the user has made the payment under the "Surveyor Report" step.

- Navigate to 'My Requests' and go to the 'Delivery' tab.

- Upload the report.

- Check if the job status is marked as complete.

Expected Output:

- Surveyor should be able to accept the job request.

- System should confirm that the user has made the payment.

- 'Upload' button should be available under the 'Delivery' tab.

- Surveyor report should be uploaded successfully.

- The user should be able to download the uploaded report from their "Surveyor Report" tab.

- The job should be marked as complete.

Actual Output: The surveyor was able to accept the job request. The system confirmed that the user made the payment. The 'Upload' button was available under the 'Delivery' tab. The surveyor report was successfully uploaded. The user was able to download the uploaded report from their "Surveyor Report" tab. The job was marked as complete.